Why students order last minute assistance with assignments from us

You have the flexibility to chose an assignment expert that suits your budget and quality parameters. We have more than 2000 PhD experts available to assist with assignments.

-

Order Preview Before Final Work

You get a preview before making final payment.

-

Pay Using different channels

You can pay using multiple secure channels, such as PayPal or Credit Cards.

-

Plagiarism Free Work Guaranteed

We sent unique content with no plagiarism.

-

Ping Us On Live Chat

You can talk to us anytime around the clock. We are up for the support.

-

Choose Your Own Expert

We let you chose from the pool of 2000 PhDs tutors.

-

Go Mobile

You do not need to be on laptop all the time, our mobile interface is great to use.

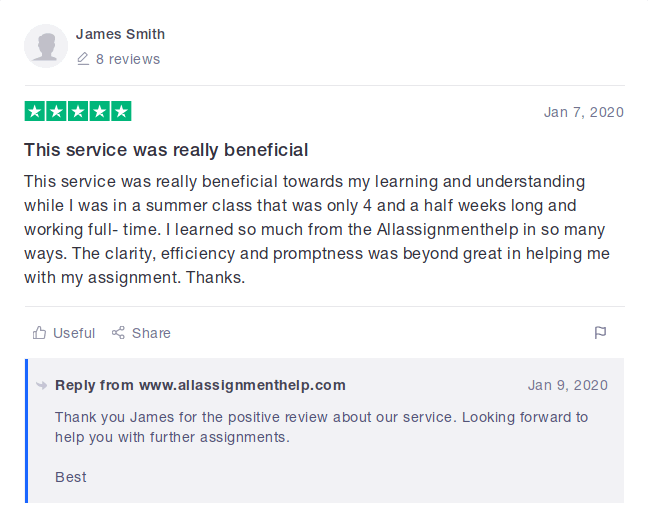

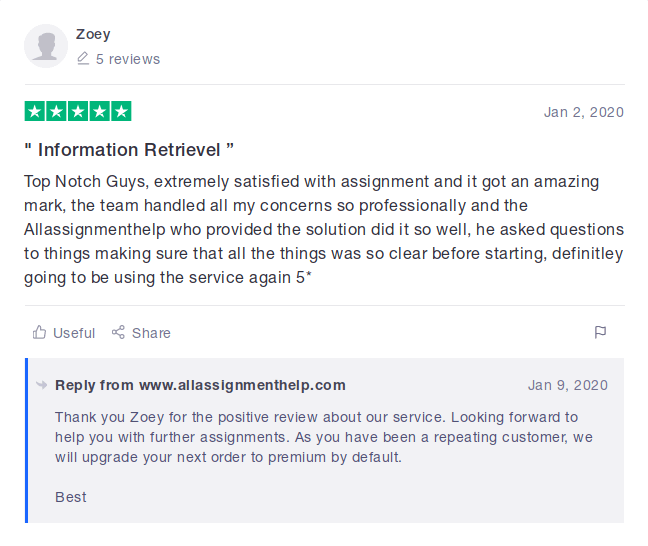

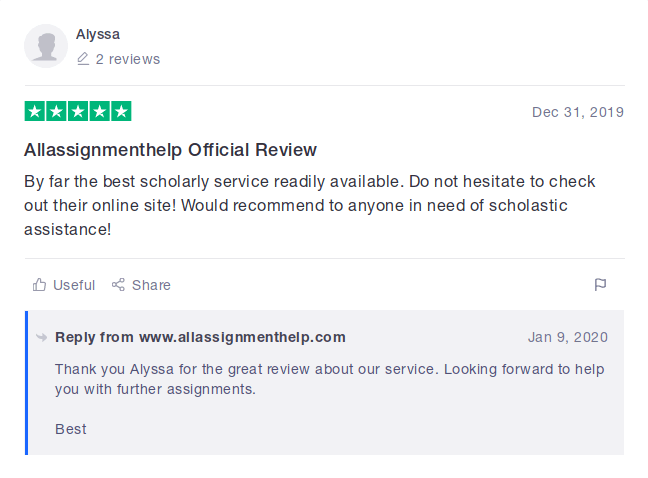

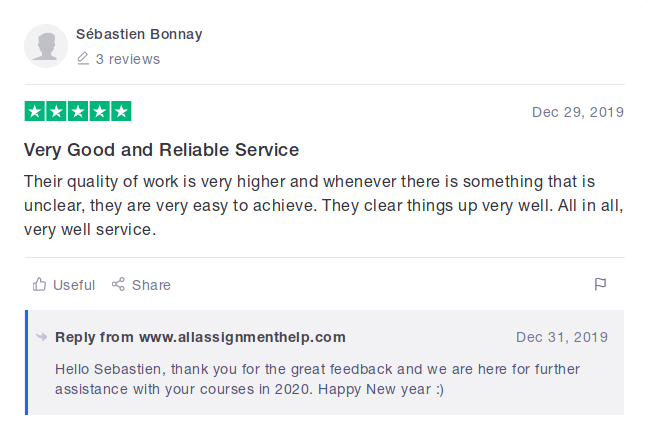

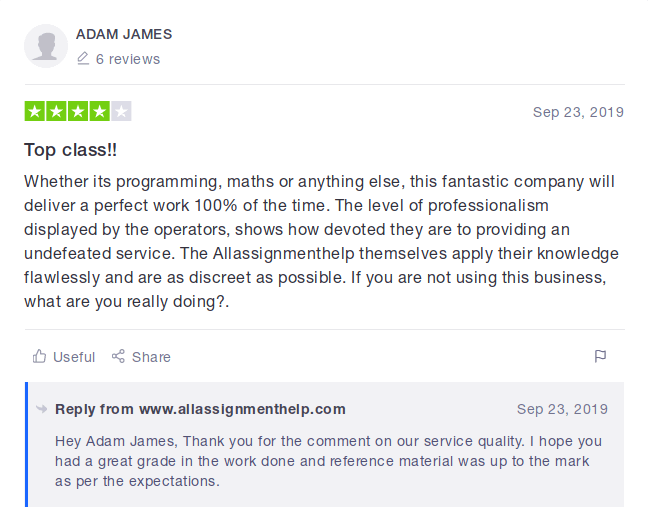

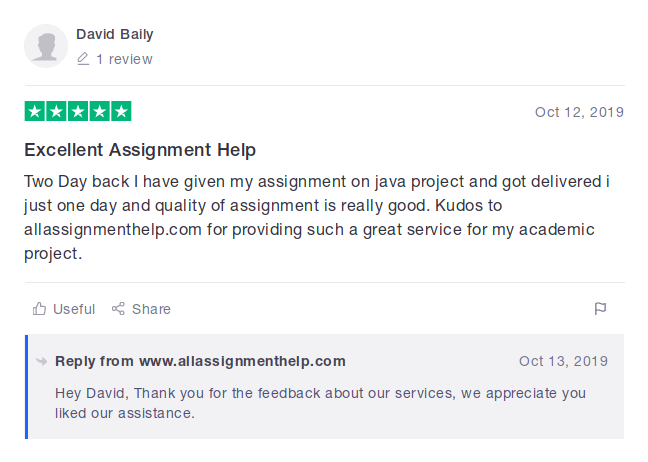

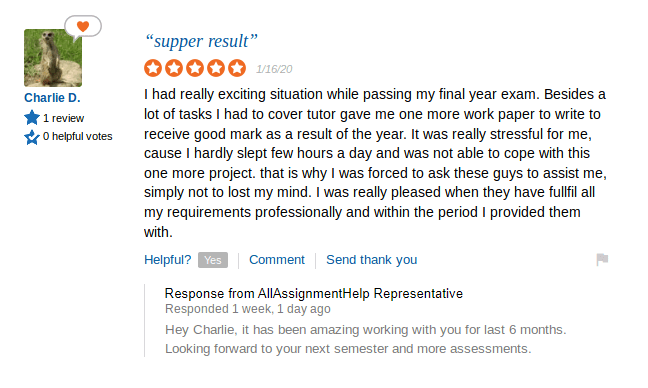

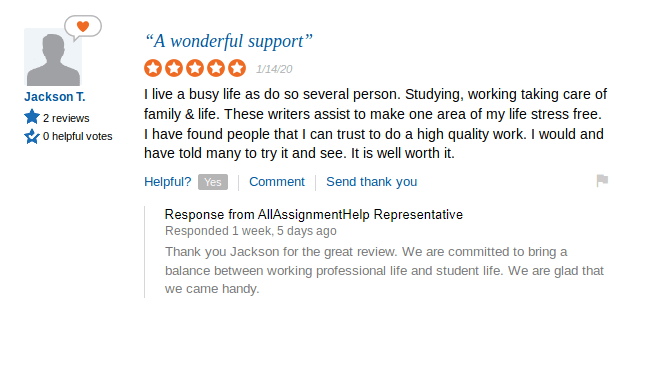

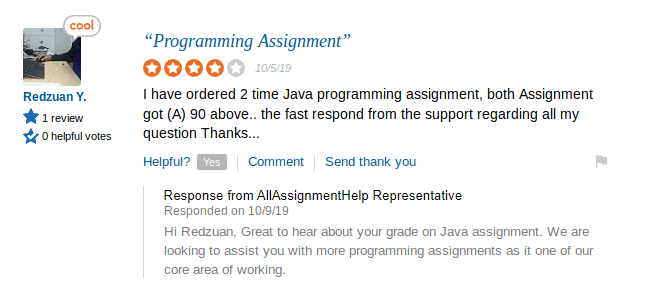

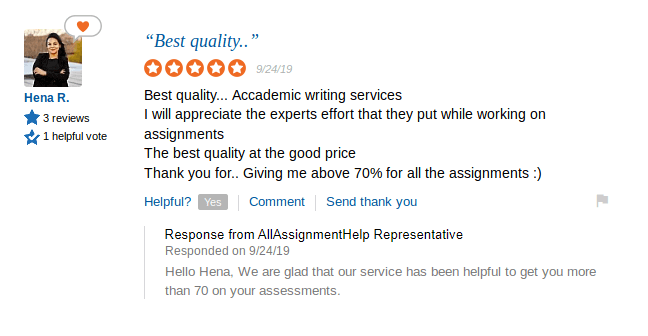

Reviews and Trust Go Hand In Hand

Allassignmenthelp.com has garnered nothing but praise from the clients. Any trustworthy review platform has positive review about our service and gives us motivation to improve.

Claim Your Offer

30% OFF & 150% Cashback on your First order !

Type your whatsapp number to get an exclusive code.

Recent Completed Projects

You can look at some of the samples that we did recently, we strongly recommend not to use samples for writing your assignment.

Want to see your dream come true of becoming a topper?

We are here to fulfil your dreams.

Place Your OrderIntroduction

The Company needs to effectively manage the financial resources to maximize its profit to attain success in the market. Financial statement prepared by the company provides information about the effectiveness with which company is conducting its operation. The report is prepared to identify benefit which will arise to the management of Amcor in preparing afinancial statement. The Amcor is an Australian based multinational company producing rigid and flexible plastic packaging. The company headquarter is in Zurich Switzerland and also maintain former head quarter and is listed in Australian securities exchange. The company was formed during the year 1986 and started manufacturing pulp paper and other paper boat product along with flexible and packaging. The report will help in identifying the company objective of preparing afinancial statement to collect the information and identify potential users of thefinancial statement. The report also contains the use of avarious analytical tool which helps different stakeholder to make informed decisions in relation to the business. Also, it analyses different components of financial statement to collect information in relation to the business. The report also discussesdifficulty which arises at the time of implementing this concept by the management of Amcor. At the end, report contains self-reflection about learning which he/she obtained at the time of working on the topic.

TheContextofYour ChosenOrganization

The chosen organization for the assignment is Amcor which is the global leader in the responsible packaging supplying a broad range of rigid and flexible packaging into the food, beverage, home, tobacco and personal care industry. The company currently has its operation in around 43 countries and has operated with around 195 sites all around the world (Amcor, 2017). The company during the year 2016 has over 31000 employees and the sales during the year 2016 werethe US $ 9.5 billion.

The company is currently focusing on the flexible and rigid plastic segment where theflexible market is around 68% and therigid market is 32%. The high growth emerging market of the company is Australia, NZ – 6%, Western Europe - 33% and North America 29%, and generates around 32% of the sales from the market.

Flexibles is one of the largest suppliers of the flexible packaging and the packaging of the carton which can be folded. The segment is working with three operation division each manufacturing packaging for their respective industry which are Europe, Middle East and Africa and America, Asia Pacific and global tobacco packaging (Amcor, 2017).The division supply wide range of the product to food, tobacco, health care and beverage. The key growth drivers of the segment are aglobal footprint, emerging market growth, strategic marketing, and advantage cost position and product innovation.

The rigid plastic is one of the largest producers of polyethylene terephthalate (PET) packaging and also manufacture container using other plastic material. The segment manufacture wide range of packaging product for the customer which are water, juice, sports, wine, and beer, sauces plastic cap for beverage application and pharmaceuticals. The key growth driver of the segment is innovation leadership, manufacturing excellence, awide range of technology and material, diversified product business and emerging market growth.

Value of the concept to the financial management of the organization

Objective of the financial statement

The success of the business highly depends upon the way company manage its financial resources. For this, the company needs to prepare the financial statement which provides information in relation to the key area of the business (Hoskin, et. al., 2014).The financial statement is generally produced to identify the profitability of the business during the particular period of time. The few of the key objective of preparing the financial statement for management of the Amcor and the other financial users are-

Information on the profitability – The financial statement produced by the Amcor will provide the information about the profitability of the company to the management and the other stakeholder which are associated with the company. It also provides acomparison of the result of the company during the various periods so the timely action may be taken in relation to the same (Palea, 2014).

Solvency position – It also provides the information about the current position of the company in relation to its ability to pay short-term as long well as long term liability of the company. Thus the financial statement helps the management of Amcor in avoiding the situation of the liquidation and creating the trust with the creditor of the company.

Identifying the growth of the business – The financial statement assist in making acomparison of the different year to draw ameaningful conclusion over the growth of the company. The management of the Amcor can also use the financial statement to make the comparison with the competitor to identify the current position of the business in the market (Wahlen, et. al., 2014). For instance, the increase in the profitability is the sign of growth for the business.

Identifying business financial strength – It also helps the management of the Amcor to identify the solvency position in order to answer avarious question such as thecompany is capable of purchasing the assets from the existing resources or repay all its liability as and when they become due. For this, the company can make the use of the various analytical tools which are discussed later in the report.

Making comparison and selection of the appropriate policy – The financial statement assist the management of the Amcor in making aninformed decision in relation to business by facilitating logical comparison with the other industry operating in the similar segment (Henderson, 2015). It also facilitates measuring theperformance of avariable segment of the company to identify the loopholes in the existing process in order to maximize the company performance.

Forecasting business situation – The management of the Amcor uses the information of the financial statement in order to forecast the future business condition based on the past data. It assists the management to identify the weak points of the company and provide acorrective measure to overcome the same (Kim, et. al., 2013). It also facilitates the management in preparing the budget which is the most effective tool for managing financial performance of the business.

Communicating with different users – the statement can be used by the management to report the financial position and performance of the company to thevarious stakeholder. It is the key to the successful management of a commercial enterprise. The financial statement presents the data in aprecise format which provides anunderstanding of the same to the different users of the financial statement.

Meeting out government regulation – The financial statement helps the government in identifying that the company is effectively meeting out its legal obligation and effectively fulfilling its tax liability (Weil, et. al., 2013).

Improving efficiency of the business – The management of the Amcor can make the use of the financial statement to evaluate the performance of the different units.

Potential users of the company financial statement

The financial statement produced by the Amcor will assist a lot of users in making akey decision in relation to the business. The users of the financial statement can be classified as internal and external users where internal users are the management who uses accounting information to make adecision in related to the company operation. On the other hand, external users are those who are not the part of the operation of the company but hold some of the financial interest. They can be further classified as the users under the direct and indirect financial interest. The following are the users of the financial statement of the Amcor limited-

Owner and the investor - the owner of the Amcor required information to make decisions in relation to their investment that is held, buy more and sell. The investors need information about Amcor potential for success and profitability to make investment decisions with the company. Moreover, owner of the business needs to open the information about profitability that makes the decision that whether to continue, improve or leave the business (Warren, et. al., 2013). This information can be obtained by analyzing thefinancial statement of the company using various analytical tools.

Management - the management of the Amcor consists of hired professional who is responsible for operating the part of thebusiness and generally act as an agent of the owner. The management whether theowner or hired have to make aneconomic decision in the regular course of the business such as a number of suppliers, availability of the cash, profit made during the last year which requires analyzing of the financial statement. The management of the Amcor makes the use of the financial statement to assess current position of the business and make afuture decision on the basis of the same.

Lenders – The lenders and the other financial institute assess the company ability to repay its liability upon maturity through its financial statement. These financial institute uses the financial statement for the purpose of deciding whether to grant the loan to the creditor. Also, they ensure that decision to lend to the company should be supported by a sufficient asset base and liquidity. The financial institute also asses the financial statementsof the company to determine whether the company is capable to repay the loan.

Trade creditor – Unlike the lender the trade creditor of the Amcor is also interested to identify the company ability to discharge its operation (Brüggemann, et. al., 2013). They are especially interested in the company ability to discharge its short term liability which can be ascertained using current and quick ratio.The suppliers of the Amcor need the financial statement to assess the credit worthiness of the company to ascertain whether to supply goods on credit.Also, they set the term of the credit on the basis of the financial strength of the company.

Government – The government bodies are interested in the financial information of the Amcor in order to determine the liability of the taxation and other regulation. The taxes are computed on the basis of the result of the operation which can be ascertained through afinancial statement (Weygandt, et. al., 2015). The financial statement also helps thegovernment to keep the track of the economic progress from adifferent sector of the economy.

Employee – They are also interested in the stability and profitability of the company and uses the financial statement to determine company able to pay salaries and provide employee benefit. They also use the financial statement to identify thepossibility of the company expansion and the opportunity of the career development.

Customer – In the long run the Amcor has built agood relationship with the customer so, the customer is interested in the existence and the stability of the company (Lee, 2014). They also assess that the company has enough resources to ensure asteady supply in the near future. Competitor – The major competitor of the Amcor are Bemis Co Inc, ProAmpac and Bryce Corporation Which compares the performance with the company which learns and developsstrategy for the purpose of developing their competitiveness.

General public – They use the financial statement to identify the effect of the company over the economy, environment, and the local community.

Implication of these concepts over the Amcor

The management of the Amcor limited makes the use of the financial statement to ascertain the current position of the company and the way they can grow in the near future. For this, the management of the Amcor uses various analytical tools to make aninformed decision in relation to the business. The most effective tool is the ratio analyzes which express the relation between the various items of the financial statement.

Liquidity ratio – The most common liquidity ratio is the current ratio which helps in ascertaining company ability to discharge its short-term liability (Vogel, 2014). These ratios are used by the creditor to identify the company ability to discharge its short term debts.

Current ratio – The current ratio measure the company ability to discharge its short term obligation. For Amcor, the low value doesn’t indicate the critical problem as the company can borrow against the prospect to meet out the obligation in the short run.

| Jun 2015 | Jun 2016 | |

| Current ratio | 0.93 | 0.88 |

"I guess I have found the right place where I can rely for my assignments. I had to complete an English assignment a few days back, and the deadline was near. I came across this website, and my life took a turn. They offer discounts which are genuine and also the quality is of top notch. My assignment reached to me before the deadline. Thanks guys."

Liza M.,

Malaysia

The current ratio of the Amcor has declined from the past year but is not the major concern as the company has agood position so that it can easily meet out its liability in the short run.

Quick ratio - it indicates the company ability to meet short term obligation through more liquid assets.

| Jun 2015 | Jun 2016 | |

| Quick ratio | 0.60 | 0.53 |

The quick ratio of the Amcor has also declined from the past year which indicates that the company ability to discharge its short term liability has reduced.

Profitability ratio – It indicates the company ability to convert sales into the profit and cash flow. The key profitability ratio is gross profit, operating profit, and net income margin. The ratio helps the stakeholder and the investor to identify the profitability of the company to make their investment decision (Delen, et. al., 2013).Also, the ratio is used by the government to access the tax liability and by employees to identify the profitability of the company.

Gross profit – the ratio is calculated by dividing the gross profit by the revenue and needs to be bigger to cover the labor, advertisement, rental and other cost required in selling the product.

| Jun 2015 | Jun 2016 | |

| Gross profit ratio | 20.10 | 21.17 |

The gross profit of the Amcor has increased from the past year which indicates that the company has increased its sales which arepositive sign for the company.

Net profit – The ratio is calculated by dividing the net income with the total revenue and can be manipulated by adjusting, depreciation, depletion, amortization and other non-recurring items.

| Jun 2015 | Jun 2016 | |

| net profit ratio | 9.1 | 4.2 |

The net profit ratio of the Amcor has declined from the past year which indicates that in spite of theincrease in sales the net profit of the company has declined which shows that the company is not effectively managing its business expenses.

Operating profit ratio - The ratio is calculated by dividing the operating income with the total revenue and is used to measure the efficiency with which the company is managing its operation.

| Jun 2015 | Jun 2016 | |

| Operating profit ratio | 10 | 10.5 |

The operating profit of the Amcor has declined from the past year which indicates that the company is not effectively managing its operation.

Earnings - per share – It is the profit per share which is available to the shareholder and for calculating the same the dividend on the preferred stock needs to be subtracted from the total net income.

| Jun 2015 | Jun 2016 | |

| Earnings per share | 2.23 | 0.83 |

The earning per share of the Amcor has declined from the past year which is due to declining in the operating and net profit during the year (Almamy, et. al., 2016).

Solvency ratio – The solvency ratio indicates the financial stability and whether the company is able to discharge its liability in the long run. The ratio helps in identifying the relation between the debts and the equity of the company. The information is used by the lenders to access the financial soundness of the company.

Debt to equity ratio – The ratio is of total debts to total assets and helps in identifying the solvency position of the business.

| Jun 2015 | Jun 2016 | |

| Debt to equity ratio | 2.45 | 5.54 |

The company debt to Equity ratio has increased over the past year which indicates animprovement of the solvency position as the company has discharged its debts.

Efficiency ratio – The most common efficiency ratio are inventory turnover and receivable turnover which helps the management in identifying the efficiency with which the management is conducting its operation (Enekwe, 2015).

Inventory turnover – The ratio measure the speed with which the company is converting its inventory during the year and is calculated by dividing the cost of goods sold of the company with the total assets.

| Jun 2015 | Jun 2016 | |

| Debt to equity ratio | 6.07 | 6.02 |

The inventory turnover ratio of the Amcor has decreased over the past year which indicates areduction in the efficiency of the business.

Return on assets – The ratio calculates by dividing the net income by the average total tangible assets and helps in identifying the effectiveness with which the company is utilizing its financial assets.

| Jun 2015 | Jun 2016 | |

| Return on assets | 9.5 | 4.6 |

The return on assets of the Amcor has declined over the past year which is due to decrease in the net profit of the company from the past year.

Note: This is not a complete solution. You can request the complete solution by filling out the order form towards your requested assignment.

Place Order For A Top Grade Assignment Now

We have some amazing discount offers running for the students

Place Your OrderREFERENCES

• Almamy, J., Aston, J. and Ngwa, L.N., 2016. An evaluation of Altman's Z-score using cash flow ratio to predict corporate failure amid the recent financial crisis: Evidence from the UK. Journal of Corporate Finance, 36, pp.278-285.

• Amcor, 2017. Amcor about us. [online] Available at: https://www.amcor.com/investor-relations/about-us [Accessed on 14 august 2017].

• Brüggemann, U., Hitz, J.M. and Sellhorn, T., 2013. Intended and unintended consequences of mandatory IFRS adoption: A review of extant evidence and suggestions for future research. European Accounting Review, 22(1), pp.1-37

• Delen, D., Kuzey, C. and Uyar, A., 2013. Measuring firm performance using financial ratios: A decision tree approach. Expert Systems with Applications, 40(10), pp.3970-3983

• Enekwe, C.I., 2015. The relationship between financial ratio analysis and corporate profitability: a study of selected quoted oil and gas companies in Nigeria. European Journal of Accounting, Auditing and Finance Research, 3(2), pp.17-34

• Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting. Pearson Higher Education AU.

+1-817-968-5551

+1-817-968-5551 +61-488-839-671

+61-488-839-671 +44-7480-542904

+44-7480-542904