Behavioral finance is a well-established field now. It brings finance and psychology on one single platform. It combines behavioral and cognitive psychological theory with economics and finance facilitating the explanation to the irrational financial decisions made by people and institutions. Hence, a student who is doing behavioral finance assignments is expected to excel at multiple areas of study at once. In case, you do not have the necessary skills, you can take our help with behavioral finance assignments online. We have been the best online assignment help website offering help with finance assignments in the US, the UK, and Australia.

Understand Important Concepts of Behavioral Finance before you do your Assignment

Behavioural finance is a broad area of study falling under the umbrella of finance, however, there are few important concepts that are worth reading. You can read about these topics in detail on our blog and other open sources on Google.

- Anomalies in Behavioral Finance: There are few anomalies that are regularly occurring in the conventional economies. It formed the basis of behavioural finance. Few of the interesting anomalies are the January Effect, The Winner’s Curse and Equity Premium Puzzle. The last one has baffled finance experts for a long time, and people are still working on it.

- Anchoring: It is the concept that attaches our thoughts to a reference point that might not be effective in decision making. It is a complex yet so interesting concept to learn. Use our Finance assignment solutions to learn more about Anchoring and related concepts.

- Mental Accounting: It is the tendency of people to create separate accounts subjective to the use of the money. Every account might have a different source of money. It is illogical thinking and hence termed as mental accounting.

- Confirmation and Hindsight Bias: It is a handy concept that one should understand before taking up any behavioural finance assignment. It is the common perception that we believe in what we see. Confirmation and hindsight bias affect our belief, and it is an interesting topic to read in behavioural finance.

- Overconfidence: It is a key concept that states that overconfidence investing can be detrimental to the stock. It is inspired by the simple concept of overconfidence where a participant can make wrong decisions driven by excessive confidence.

There are several concepts in behavioural finance; however, we have listed a few important ones already. There are few other concepts like Prospect Theory, overreaction and availability bias, etc. Mastering these concepts is imperative to submit a well written finance assignment. In case you don't see a way out and stuck with the assignment, you can always ask for help with finance assignment. We never shy away from helping students online.

Behavioral Finance Help is just one area, Take Online Assignment Help with Other Subjects of Finance

AllAssignmentHelp.com has complete online assistance available for you behavioural finance assignments. However, it is not enough as students cannot go to othe websites expecting for help with other major areas of finance. Hence, we make sure you get finance assignment help from a single website without wasting time finding others.

- International finance: We get so many requests from the students for International finance. International finance is actually a complicated and difficult subject that deals with the communication of two or more countries. With our best writing service, you can only get a high-quality paper.

- Financial accounting theory: Financial Accounting is both the art and science of collecting, recording and compiling financial information into precise formats. Students find it difficult to write assignments on financial accounting theory and thus they request us for assignment help.

- Activity-based cost: The activity-based cost concept refers to a different way of accounting for manufacturing activities. Many students come to us for activity-based cost assignment help. We never disappoint them and always provide them with a high-quality paper so that they can get an A+ in their paper.

- Time value of money: Time value of money is a financial theory that describes the idea of the present value of money is more than the same amount in the future due to its potential earning capacity. You can easily avail our time value of money assignment writing help service at a reasonable price.

How to Place Order if you Need Behavioral Finance Homework Help?

Placing an order online for assignment help is easy on our website. All you need to do is come to us and ask do my assignment online and send your files. Here are the steps to follow:

- Share assignment file - You need to send your finance homework so that we can review it and check the feasibility of doing it.

- Pay for online homework help - Once you hire an online finance assignment expert, you need to pay for online homework help. You only pay the agreed price and also you can choose to pay partial amount.

- Get custom assignment help - You get a custom written assignment from the scratch, which is free from plagiarism.

- Submit assignment and enjoy top grades - You can submit your assignment to university for evaluation and enjoy the top grades as our help with behavioural finance homework comes with guarantees.

- If any rework, feel free to ask for revisions - In case there are any changes asked by your college professor or you feel something is not right, just raise a revision request. No questions asked.

Since we have been helping students with college assingment for a long time, we have become a top choice for homework writing service in top Australian and American institutions. We have been helping students with variety of assignments other than just finance.

Need help with behavioural finance assignment?

Hire qualified finance helpers online

Place your order

Why is Allassignmenthelp.com is the Best Online Assignment Help Service when it comes to Finance Homework?

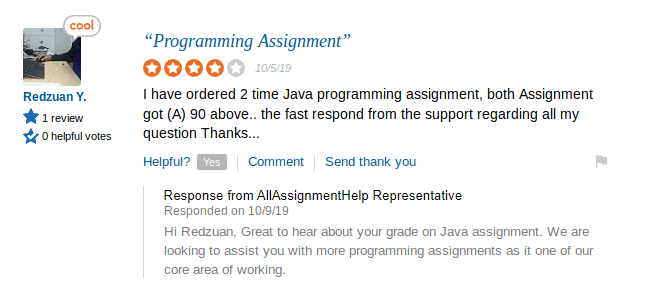

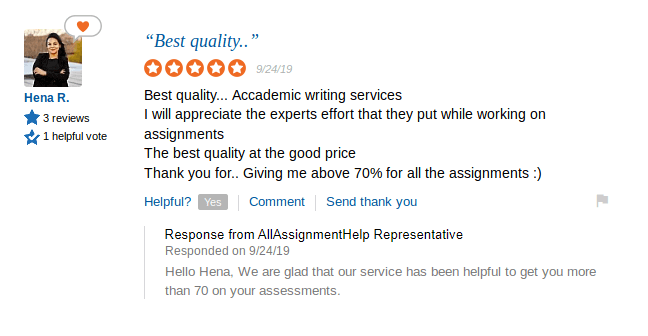

Students vouch for our online homework help service for many reasons. It is not just about the price, our quality of assignment writing speaks for ou service. Here ae few pointers to get started why you should get your assignment done from our online finance experts.

- Assignment help for cheap - You don't have to pay a hefty amount to get your assignment done as we offer cheap assignment writing help to all students.

- Plagiarism report support - We know universities check your assignment through a plagiarism checking tool and you cannot risk submitting a copied assignment. Hence, we make sure you get the free plagiarism report.

- Native assignment expert - You get an assignment writing expert in you location. Hence, a student from the UK, will get an online assignment expert in UK , Australian student will work with a writer in Australia and so on.

Check our Behavioural Finance Assignment Sample - FINC3023 University of Sydney

Below is the sample of behavioual finance cousewok from the University of Sydney. Below is the task desciption and we have addessed the behavioural finance assignment based on the task and structure provided by the college.

You are an associate in the consumer research group at a Sydney commercial bank or other financial institution. There has been growing interest in behavioural finance topics across a number of areas in the bank. Your manager has noted that it might be a good idea to write a memo describing behavioural finance insights and some of their implications for financial products. To this end she has suggested that your team prepare draft of a brief (no more than 4 page) executive memo. In it you would outline a particular behavioral insight and then link it to a particular financial product (or decision) by customers in the financial markets.

Behavioral finance evaluates psychology of decision making related to finance. Many people are aware of the fact that the emotions impact investment decisions. Many individuals in industry talk commonly about role which fear and greed play to drive the stock markets (Bikas, et al., 2013). The behavioral or Behavior based finance stretches the analysis towards the biases role in making of decision like using simple thumb rule to make complex decisions of investment (Bikas, et al., 2013). The behavioral finance undertakes psychological research insights and implements it to decision making of finance.

It has been proven by Psychology that human beings have confidence which is unwarranted in the decision making process. In its essence, this means to have an inflated perspective regarding own abilities. The trait is universal and affects many aspects of the lives of people (Sukanya, et al., 2015). The researchers (Palomino, et al., 2011) asked individuals for rating their abilities as compared to others. Many people often rate themselves at the ranking of top third in the population. The human beings have the tendency for viewing the world with positive attitude. Though this behavior is valuable, it may help for recovering from the disappointments of life quickly.

Relevance/Importance

Overconfidence directly impacts the future forecasting of investment decision and are complex phenomenon. The investors who are overconfident overestimate the ability for identifying the winning investments. Theories related to traditional finance suggests that portfolios which are diversified must be held to not let the risk get concentrated at a specific area. Convictions that are misguided may weigh in opposition to this advice which makes them be certain of the fact that spread and diversification is not necessary. Overconfidence is associated with control issues with investors who are overconfident like for instance it is believed that they often exercise greater control on the investments as compared to what they do. In a research study, it was reported by affluent investors that their skills of stock picking were crucial to performance of portfolio (Bodie, 2013).

How it has been explored by others

Behavioral finance paradigm gives suggestion regarding decision related to investment which is impacted in large proportion by emotional and psychological factors. Investors may not act reasonably or take into consideration all the information which is available in their process of decision making. In result, they make the errors regularly. It comes to the conclusion that errors which they repeatedly make in similar way are termed as systematic errors.

Other Competing Explanation

Optimism in Excess may cause Overconfidence. The investors are overconfident consistently if they outperform in the market in their ability. However, many are not able to perform the same. AT the optimism’s height, the greed shifts the stock away from the intrinsic value which creates a market that is highly overpriced. Fear and anxiety moves the prices lower than intrinsic value which creates an undervalued market (Sukanya, et al., 2015).

Implications for Consumer Finance product

Description of Product

Investment Advice

Behavioral Finance gives the suggestion that all advisors must derive advantage to develop awareness, knowledge and understanding to mental and frame accounting. The advisors may focus over the specific mental account which the client is having as well as the risk and objectives tolerance for everyone also, it is not possible for establishing an overall single risk based tolerance. Instead, the client can possess a varied tolerance of risk for the ISA (Barberis, et al., 2003) pension etc. the advisors must give counselling to clients for evaluating the financial assets with broader frame. It is possible to avoid concentrating over the instruments and securities of individual (Barberis, et al., 2003).

Portfolio Management

The overconfidence’s impact over asset prices and investment strategies has gained much attention in previous decades specifically on behavior of individual investors (Peteros, et al., 2013). The key participants of financial markets are the institutions that are characterized through delegating decision related to investment to the managers of professional money which requires designing of compensation contract that influence their investment decisions.

Feature of product which makes behavioral insight relevant

In prior versions of theory of portfolio, the economists gave the suggestion that many investors want to balance their security by having small choice for large winnings Therefore, allocations of portfolio must be on the basis of lotteries and insurance that is small odds for large pain and loss protection respectively. Many researchers view behavioral portfolio as a layered pyramid in which base layer depicts assets for providing protection from the property for avoiding loss (Ritter, et al., 2003). Higher layer depicts the aspiration for the riches and make investment in risk based assets to earn high returns.

Influence on Customer Behavior

The individual investor may simultaneously portray risk tolerant and risk averse behavior which depends on the mental account. But in reality, they underestimated effect of aggregate market over the performance of their portfolio. In this way, the investors overestimated and overlooked the broader factors which influenced the decision regarding investments. A lot of trading investors who have excess confidence over their skills of trading trade a lot with negative effect and outcomes over the returns (Rao, et al., 2014).

How might the bank assist its customers given your insights

The banks give following advice and assistance to its customers for the over confidence:

The advisors who may help to omit the overconfidence among potential and potential overconfident customers must analyze their level of overconfidence.

The advisers must carefully consider the result of decisions of past investment by making honest assessment regarding the result. The lessons and teachings can be learned and understood for decisions in future. The traders who are more active earned lowest yields. Also, this theory suggested that investors must treat every layer isolated and must not consider any link in these layers (Peteros, et al., 2013). Established theory of finance holds that association in various assets in aggregate portfolio comprise key factors to achieve diversification.

References

Barberis, N. and Thaler, R., 2003. A survey of behavioral finance. Handbook of the Economics of Finance, 1, pp.1053-1128.

Bikas, E., Jurevi?ien?, D., Dubinskas, P. and Novickyt?, L., 2013. Behavioural finance: The emergence and development trends. Procedia-social and behavioral sciences, 82, pp.870-876.

Bodie, Z., 2013. Investments. McGraw-Hillaz.

Malmendier, U. and Tate, G., 2015. Behavioral CEOs: The role of managerial overconfidence. The Journal of Economic Perspectives, 29(4), pp.37-60.

Palomino, F. and Sadrieh, A., 2011. Overconfidence and delegated portfolio management. Journal of Financial Intermediation, 20(2), pp.159-177.

Peteros, R. and Maleyeff, J., 2013. Application of behavioural finance concepts to investment decision-making: suggestions for improving investment education courses. International Journal of Management, 30(1), p.249.

Rao, N.R., Reddy, E.S. and Aryasri, A.R., 2014. Behavioural Finance.

Sukanya, R. and Thimmarayappa, R., 2015. Impact of Behavioural biases in Portfolio investment decision making process. International Journal of Commerce, Business and Management (IJCBM), 4(4), pp.1278-1289.

Ritter, J.R., 2003. Behavioral finance. Pacific-Basin finance journal, 11(4), pp.429-437.

+1-817-968-5551

+1-817-968-5551 +61-488-839-671

+61-488-839-671 +44-7480-542904

+44-7480-542904