Key Topics

- Need Help with BUS 622 Financial Statement Analysis course Online? Hire The Experts of AllAssignmentHelp.com

- BUS 622 Financial Statement Analysis - Course Description

- Course Learning Outcomes (CLOs) Linked to BUS 622 Westcliff University Course Outcomes

- Linking Tables For The Course BUS 622 Financial Statement Analysis

- Get Detailed BUS 622 Westcliff University Course Outline

- AllAssignmentHelp.com is Here to Listen To Your take my Financial Statement Analysis BUS 622 class Request

Need Help with BUS 622 Financial Statement Analysis course Online? Hire The Experts of AllAssignmentHelp.com

Many students choose to pursue MBA after completing their graduation. They think MBA has a large scope and can help them make their future bright. One such course named BUS 622 Financial Statement Analysis is made up for students that are offered by Westcliff University, College of business to provide an opportunity to students to make a career in financial domain. Students obtain a thorough understanding of the entire financial reporting, financial statement analysis, and valuation process via this course. The best part is that Westcliff University offers the course online. Now, you can get your degree in Financial Statement Analysis just by sitting at your comfortable pace. Also, if at any stage you need to pay someone to take my online class for me for the BUS 622 Westcliff University course, you can hire online class helpers.

Now, let’s discuss what the course is all about and what you need to follow to pass the course.

BUS 622 Financial Statement Analysis - Course Description

- Units: 3

- Length of the class: 8 Weeks

- Course Description: Students will get a thorough understanding of the entire financial reporting, financial statement analysis, and valuation process in this course. They will study how investors and analysts perceive and analyse a company's profitability and risk, as well as how they use that information to estimate future profitability and risk, and ultimately value the company, allowing for more informed investment decisions.

The function of accounting, financial reporting, capital markets, investments, portfolio management, and corporate management in the global economy all require an understanding of this process.

- Required Texts: Wahlen, J., M., Baginski, S., P., & Bradshaw, M. (2018). Financial reporting, financial statement analysis, and valuation (9th.ed). Cengage Learning.

Print ISBN: 9781337614689, 1337614688

eText ISBN: 9781337668262, 1337668265

- Methods of Instructions: In both a classroom setting and an online learning system, students communicate with one another and with professors. Lecture-discussions, presentations, cooperative learning, and case studies will be used to aid learning.

- Course Scope: Professional individual assignments, discussion postings, thorough learning tests, and class participation are used to assess student outcomes. However, you can pay someone to do my assignment to AllAssignmentHelp.com for well-written assignments and related writing tasks.

Course Learning Outcomes (CLOs) Linked to BUS 622 Westcliff University Course Outcomes

Learning outcomes are statements that summarise essential and crucial learning that students have accomplished and can demonstrate reliably at the end of the course. The learning outcomes for this course explain what students should expect to learn and how this course relates to the MBA degree's educational goals. MBA, being an prestigious degree contains many obstacles, thus, taking MBA assignment help from us could prove helpful to you.

| Course Learning Objectives (CLOs) | MBAProgram Objectives |

(K) Knowledge (S) Skill (A) Attitude |

| Recognize the impact of operating, investing, and financing decisions on financial statements and how financial analysts interpret results. |

1, 2, 3, 4, 5 | K, S |

| Analyze financial statements using knowledge of the underlying accounting principles and financial analysis techniques. |

1, 2,3,4, 5, 6 | K, S, A |

| Apply financial statement analysis to assess the solvency, profitability, liquidity, and debt-paying ability of a business. |

1, 2, 3, 4, 5, 6, 7 |

S |

| Identify SEC rules affecting financial reporting and disclosure | 1, 2, 3, 4, 5, 6, 7 |

K |

| Explore career opportunities in the accounting and finance fields. | 1, 2, 3, 4, 5, 6, 7, 8 |

K, A |

Linking Tables For The Course BUS 622 Financial Statement Analysis

Course Learning Outcomes are measured directly by Comprehensive Learning Assessments (CLAs), Professional Assignments (PAs), and Discussion Questions (DQs), whereas MBA Program Outcomes are measured indirectly by CLAs, PAs, and DQs. The table below illustrates how they are all connected.

CLA Linking Table

| Comprehensive Learning Assessments (CLAs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| CLA 1 (Week 4) | 2, 3, 4 | 1, 2, 3, 4, 5, 6, 7 |

| CLA 2 (Week 8) | 2, 3, 4 | 1, 2, 3, 4, 5, 6, 7 |

PA Linking Table

| Professional Assignments (PAs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| PA 1 (Week 2) | 1, 2, 3 | 1, 2, 3, 4, 5, 6, 7 |

| PA 2 (Week 6) | 4, 5 | 1, 2, 3, 4, 5, 6, 7, 8 |

DQ Linking Table

| Discussion Questions (DQs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| DQ 1 (Week 1) | 3 | 1, 2, 3, 4, 5, 6, 7 |

| DQ 1 (Week 2) | 1, 2 | 1, 2, 3, 4, 5, 6 |

| DQ 1 (Week 3) | 1, 2, 3 | 1, 2, 3, 4, 5, 6, 7 |

| DQ 1 (Week 4) | 2, 3, 4 | 1, 2, 3, 4, 5, 6, 7 |

| DQ 1 (Week 5) | 3, 4 | 1, 2, 3, 4, 5, 6, 7 |

| DQ 1 (Week 6) | 4, 5 | 1, 2, 3, 4, 5, 6, 7, 8 |

| DQ 1 (Week 7) | 3, 4, 5 | 1, 2, 3, 4, 5, 6, 7, 8 |

| DQ 1 (Week 8) | 5 | 1, 2, 3, 4, 5, 6, 7, 8 |

Activity Linking Table

| Activities | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| Activity 1 (Week 1) | 1 | 1, 2, 3, 4, 5 |

| Activity 2 (Week 3) | 1, 2, 3 | 1, 2, 3, 4, 5, 6, 7 |

| Activity 3 (Week 5) | 3, 4 | 1, 2, 3, 4, 5, 6, 7 |

Get Detailed BUS 622 Westcliff University Course Outline

Week by week, the following outline gives crucial assignment instructions for this course. You are solely responsible for all of the tasks assigned to you. However, you are not alone, we also offer online assignment help with the course assignments. You can buy online assignment writing service from us without being thinking of getting caught.

Week 1

- Assignments

Reading: Financial Reporting, Financial Statement Analysis, and Valuation

Chapter 1: Overview of Financial Reporting, Financial Statement Analysis, and Valuation

Post DQ Initial Response by Thursday at 11:59 p.m.

Post DQ Peer Response(s) by Sunday at 11:59 p.m.

Submit Activity1 by Sunday at 11:59 p.m.

- Discussion Question 1 - CLO 3

Analyze at least three (3) fundamental factors for the establishment of the Sarbanes-Oxley Act in a 200-250-word response.

- Which do you believe was the most crucial to the Act's creation?

- What is the least important?

- Justify your decision.

Note: Complete all questions completely, with one (1) direct response to the discussion question prompt and one (1) peer response.

- Activity 1 - CLO 1

Consumers paid or agreed to pay $587,000. Waggoner Company performed services for which customers paid or promised to pay. By the end of 2018, $552,000 had been collected out of this total. Waggoner paid $340,000 in cash for employee salary and owed the employees $15,000 for work completed but not paid for at the end of the year. Waggoner paid $3,000 in interest and $195,000 in additional service charges. At the end of the year, the income tax rate was 35%, and income taxes had not yet been paid. Waggoner declared and paid $20,000 in dividends. There were no other events that had an impact on the cash flow.

Please respond to the following questions:

a. Prepare a year-end income statement for Waggoner (December 31 year-end).

b. Prepare the year's cash flow statement and state change (December 31 year-end) in money.

GAP is where you should submit your deliverables.

Week 2

- Assignments

Financial Reporting, Financial Statement Analysis, and Valuation are all topics that should be read.

Chapter 2: Valuation of Assets and Liabilities, as well as Income Recognition

By Thursday at 11:59 p.m., submit your DQ Initial Response.

By Sunday at 11:59 p.m., post your DQ Peer Response(s).

Professional Assignment 1 must be submitted by Sunday at 11:59 p.m.

- Discussion Question 1 – CLO 1, CLO 2

The press, for the most part, uses, interprets, and covers information included in business financial reports correctly.

In a 200-250-word response, please answer:

Search the internet for a business storey from the previous 5 years that focuses on unintended abuse, misunderstanding, or misreporting of financial reporting information.

(Note: the focus is on misuse, misunderstanding, or misreporting, not outright fraud, such as Enron, WorldCom, etc.).

Post a link to the discussion board on your blog.

- What do you think went wrong, in your opinion?

- How could the company have handled the situation better before it became public?

These two to be answered thoroughly.

- Professional Assignment 1 – CLO 1, CLO 2, CLO 3

1. GAAP mandates that value changes be recorded on the balance sheet and income statement as soon as they occur, even if they are not realised. What kinds of transactions are eligible for this treatment? What is the reasoning behind this accounting?

2. Acquisition cost, adjusted acquisition cost, and present value of cash flows using historical interest rates are the three valuation approaches that reflect historical values.

Pharma bought a patent on a novel blood analyzer from Biotech. Pharma must pay Biotech $1 million immediately under the terms of the sales agreement, which was signed on January 1, 2018. In addition, beginning December 31, 2018, Pharma must pay $700,000 every year on December 31st for the next 20 years BUS 622 Syllabus 9. Pharma and Biotech believe that a 10% discount rate is suitable for this arrangement.

- Calculate the current value of the receivable on Biotech's books on January 1, 2018, when the $1 million down payment was received.

- On December 31, 2018, calculate the present value of the receivable on Biotech's books.

- As of December 31, 2019, determine the present value of the receivable on Biotech's books.

Week 3

- Assignments

Reading: Financial Reporting, Financial Statement Analysis, and Valuation

Chapter 3: Income Flows versus Cash Flows: Understanding the Statement of Cash Flows

Chapter 4: Profitability Analysis

Post DQ Initial Response by Thursday at 11:59 p.m.

Post DQ Peer Response(s) by Sunday at 11:59 p.m.

Submit Activity 2 by Sunday at 11:59 p.m.

- Discussion Question 1 – CLO 1, CLO 2, CLO 3

Please offer detailed answers to the following questions in a 200-250 word response:

The three most essential profitability ratios are gross profit, operating profit, and net profit. Depending on the exact line item and the sort of firm, business owners and managers may find the other ratios calculated from the income statement to be of varying utility.

Find the financials for a public company.

- How do the ratios for this company compare with others in the same industry?

- Which ratios do you think are most important?

- What line items on the income statement are most significant to you or cause you the most concern?

Be sure to post a link to the financials.

- Activity 2 – CLO 1, CLO 2, CLO 3

1. Prepare a statement of cash flows (indirect method) for Sink Industries for the year ending December 31, 2018, and calculate ending cash flows using the following information:

The net income for 2018 was $5,000. Accounts receivable fell by $2,000, inventories rose by $4,000, and accounts payable fell by $7,000. Depreciation expense of $8,000 was reflected in net income.

During the year, a plot of land set aside for future growth was sold for $8,000, and a new service truck was purchased for $14,000.

The company borrowed $18,000 from the bank on a two-year note. A total of $6,000 in dividends was paid out in cash. To retire $7,000 in long-term notes payable, preferred stock was issued.

The beginning cash balance was $10,000.

2. Consider the following financial numbers for Carradine Company and then prepare answers to the required questions.

For the year 2019, Carradine Company had a net income of $1,903 million on revenues of $55,618 million. The preferred dividends totaled $13.5 million, with an interest expenditure of $0.459 million. For the year, the average total assets were $17.5 million. The federal income tax rate is 21%. The average equity of preferred shareholders was $250 million, and the average equity of common shareholders was $7.5 million.

- Calculate the return on assets (ROA) and break it down into profit margin and asset turnover components.

- Calculate the rate of return on common stock equity (ROCE) and break down the components of ROCE into profit margin, assets turnover, and capital leverage ratio.

- Determine the number of net profits distributed to common stockholders.

Week 4

- Assignments

Reading: Financial Reporting, Financial Statement Analysis, and Valuation

Chapter 5: Risk Analysis

Chapter 6: Accounting Quality

Post DQ Initial Response by Thursday at 11:59 p.m.

Post DQ Peer Response(s) by Sunday at 11:59 p.m.

Submit CLA 1 by Sunday at 11:59 p.m.

- Discussion Question 1- CLO 2, CLO 3, CLO 4

Please offer detailed answers to the following questions in a 200-250 word response:

Some claim that earnings management is the result of management's decision to reduce the economic information content of financial reports.

- What do you think the most compelling reason for managers to undertake earnings management is?

- Why do you believe this is the case?

- Give instances to back up your claim.

However, we are always here to do your assignment for the discussion questions and you can hire us at any time you need.

- CLA 1 Comprehensive Learning Assessment – CLO 2, CLO 3, CLO 4

In answer to the following questions, a minimum of five (5) pages (excluding tables, graphs, appendices, title, and reference pages) APA structured Word Document supplemented by Excel sheets, where appropriate, is required for this Comprehensive Learning Assessment (CLA 1). Your responses should be concise, well-organized, and well-defined. Provide succinct and clear reasoning, as well as details to back up your claim.

1. Falcon Corporation has $400,000 in current assets and $275,000 in current liabilities.

- Calculate the impact on Falcon's current ratio of each of the following transactions:

- Purchased $108,000 of product inventory with short-term accounts payable after refinancing a $60,000 long-term mortgage with a short-term note

- Paid $50,000 in accounts payable on a short-term basis.

- Receipted $90,000 in short-term receivables

Week 5

- Assignments

Reading: Financial Reporting, Financial Statement Analysis, and Valuation

Chapter 7: Financing Activities

Chapter 8: Investing Activities

Post DQ Initial Response by Thursday at 11:59 p.m.

Post DQ Peer Response(s) by Sunday at 11:59 p.m.

Submit Activity 3 by Sunday at 11:59 p.m.

- Discussion Question 1 - CLO 3, CLO 4

Please offer detailed answers to the following questions in a 200-250 word response:

- Do you think stock options should be used to compensate employees?

If so, what is the reason? Why not, if not?

- Do you believe that giving employees stock options motivates them?

How so, if yes? Why not, if not

- Activity 3 - CLO 3, CLO 4

1. Discuss how intangible assets should be recorded in accordance with US GAAP. The following topics should be discussed in your response:

- Internally developed intangible assets versus externally acquired intangible assets that are particularly identifiable

- Testing for impairment and amortization

Additionally, there are some questions as well based on equity, shareholding, etc.

Week 6

- Assignments

Reading: Financial Reporting, Financial Statement Analysis, and Valuation

Chapter 9: Operating Activities

Chapter 10: Forecasting Financial Statements

Chapter 11: Risk-Adjusted Expected Rates of Return and the Dividends Valuation Approach

Submit Professional Assignment 2 by Sunday at 11:59 p.m. Post DQ Initial Response by Thursday at 11:59 p.m. Post DQ Peer Response(s) by Sunday at 11:59 p.m.

- Discussion Question 1- CLO 4, CLO 5

Please offer detailed answers to the following questions in a 200-250 word response:

Pensions have declined in popularity, while 401(k) plans have become the norm. Each plan has its own set of advantages and disadvantages.

- Which form of plan do you think is the most secure for your financial future?

Give instances to back up your claim.

- Professional Assignment 2 – CLO 4, CLO 5

In response to the following questions, submit this professional assignment in an APA-formatted Word document. Your responses should be concise, well-organized, and well-defined.

1. Forecasting sales and other operating activities is the first step in financial statement forecasting. A volume component and a price component both play a role in determining sales numbers. Pricing projections are influenced by characteristics unique to the firm and its industry, such as demand and price elasticity. Discuss whether it is conceivable that the following types of companies will be able to forecast future prices:

- A company in a capital-intensive industry that is likely to run at or near capacity for the foreseeable future (1 paragraph)

- A company in a field where substantial technological advancements are predicted (1 paragraph)

- A company whose products are migrating from the growth to the mature stages of the product life cycle (1 paragraph)

- A company that has a well-known brand name and image (1 paragraph)

Week 7

- Assignments

Reading: Financial Reporting, Financial Statement Analysis, and Valuation

Chapter 12: Valuation: Cash-Flow-Based Approaches

Chapter 13: Valuation: Earnings-Based Approaches

Chapter 14: Valuation: Market-Based Approaches

Post DQ Initial Response by Thursday at 11:59 p.m.

Post DQ Peer Response(s) by Sunday at 11:59 p.m.

- Discussion Question 1 – CLO 3, CLO 4, CLO 5

Please offer detailed answers to the following questions in a 200-250 word response:

At the moment, neither the general nor the specific level of financial reporting takes into account price variations. Many analysts argue that failing to account for price changes undermines the meaning of financial reports. What effect do you think pricing changes have on financial reports?

Week 8

- Assignments

Reading: Financial Reporting, Financial Statement Analysis, and Valuation

Review all chapters covered that will assist in the completion of the CLA 2 assignment

Post DQ Initial Response by Thursday at 11:59 p.m.

Post DQ Peer Response(s) by Sunday at 11:59 p.m.

Submit CLA 2 by Sunday at 11:59 p.m.

- Discussion Question 1 – Summary & Critical Thinking – Week/Course Learning Outcomes-CLO 5

Explore job options in the accounting and finance professions in your area in a 200-250-word response.

Choose two schools to which you'd want to apply.

- What businesses are pushing this position?

- What's the pay range for this position?

- What are the job's stated experience and educational requirements?

- Do you think you'd be interested in applying for either of these two jobs?

Within your comment, include the links.

- CLA 2 Comprehensive Learning Assessment 2 – CLO 2, CLO 3, CLO 4

This assignment involves 3 to 4 pages of APA-formatted Word document responses to the questions below (excluding tables, graphs, appendices, title, and reference pages). Where applicable, you may also provide Excel attachments to demonstrate your work. Your responses should be concise, well-organized, and well-defined. However, if you need help with APA format assignment writing, you can hire expert assignment writers from our portal.

- Examine the advantages and disadvantages of the three (3) methodologies utilized by analysts to appraise a company's stock. There are three types of approaches: free cash flow-based, earnings-based, and market-based. Give specific numerical examples.

- Consider the following scenario and fill in the last column to determine the price-earnings ratio's sensitivity to changes in the cost of equity capital and the growth rate:

Table showing Estimating price earning(P/E) ratios under various scenarios

| Scenario | Cost of Equity Capital | Growth Rate in Earnings | P/E Ratio |

| 1 | 0.13 | 0.09 | |

| 2 | 0.13 | 0.11 | |

| 3 | 0.15 | 0.09 | |

| 4 | 0.18 | 0.09 | |

| 5 | 0.18 | 0.11 |

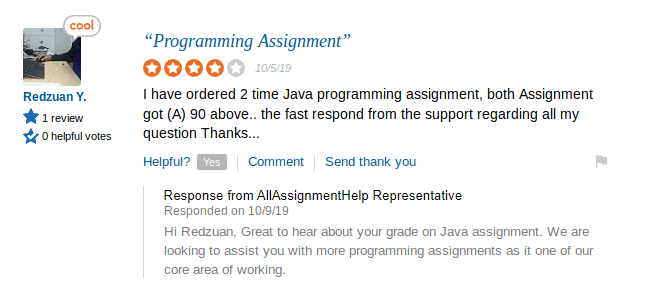

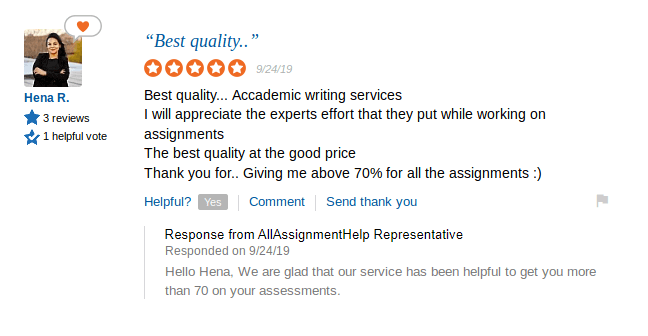

We only provide professional help to students

Get the most cost-effective online class help from us

Place your orderAllAssignmentHelp.com is Here to Listen To Your take my Financial Statement Analysis BUS 622 class Request

Are you feeling helpless and need someone to take my Financial Statement Analysis BUS 622 class? Do you need someone who could take my online exam and test for the course BUS 622? You have landed on the right page. Here at AllAssignmentHelp.com, we offer complete online course help covering all sorts of tests, assignments, classes, exams, etc. You can hire an expert by paying a nominal fee and all you set to get your online BUS 622 Westcliff University course pass with flying colors. Moreover, we are available 24 hours a day so that whenever you need us we help you timely.

+1-817-968-5551

+1-817-968-5551 +61-488-839-671

+61-488-839-671 +44-7480-542904

+44-7480-542904