Key Topics

- Get High Scoring Acct 3221 Income Tax Accounting I Assignment Paper From Allassignmenthelp

- Course Description

- Hardcover edition

- Ordering Information

- Other Materials and Resources

- Software

- Hardware

- Nature and Purpose of the Course, Course Outcomes:

- Working with the Course Materials

- Recommended steps to follow in working through each module

- Suggested Study Techniques

- Reading Assignments

- Module Assignments

- Assignment Instructions

- Recall the caveat

- Academic Integrity

- Plagiarism

- Collaboration

- Exams and Grading Policy

- Make It Easy With ACCT3221-Income-Tax-Accounting-I Assignment Writing Service From Allassignmenthelp - A True Friend of Yours!

Get High Scoring Acct 3221 Income Tax Accounting I Assignment Paper From Allassignmenthelp

Students who are doing a major or certificate course on Income Tax accounting, frequently find themselves under mountainous pressure of studying. This mostly happens due to the intricate and time-consuming assignments that are being given to them by their professors for developing skills and absorb ideas properly. This academic pressure is good as it keeps students in a routine but it has been observed that, due to this unparalleled pressure, many students get failed in fetching better marks and goes in depression or anxiety for their ill academic performance.

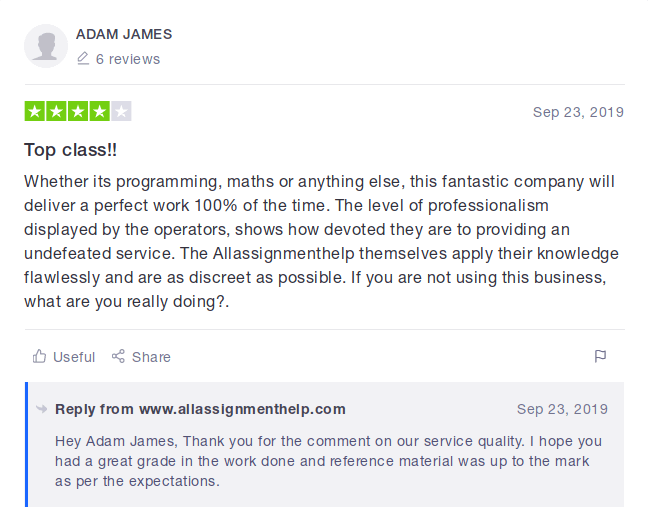

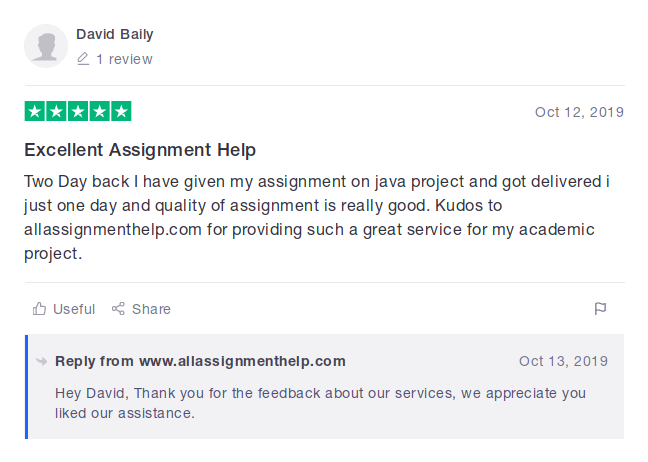

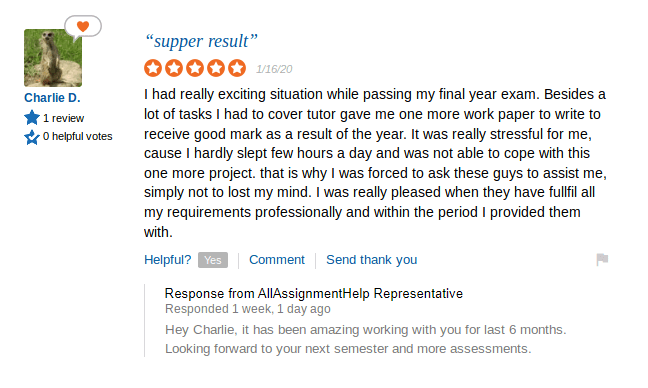

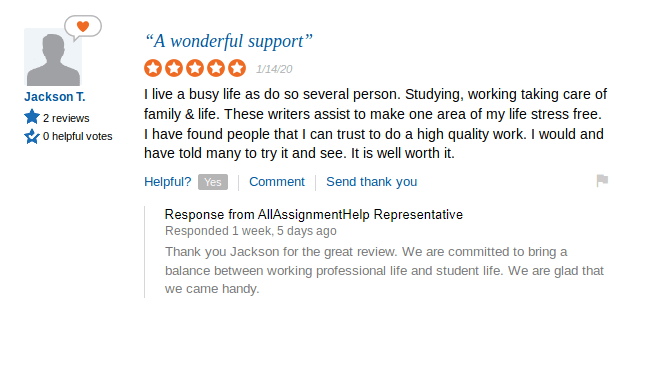

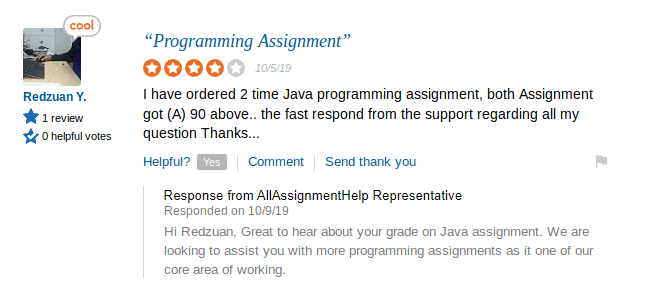

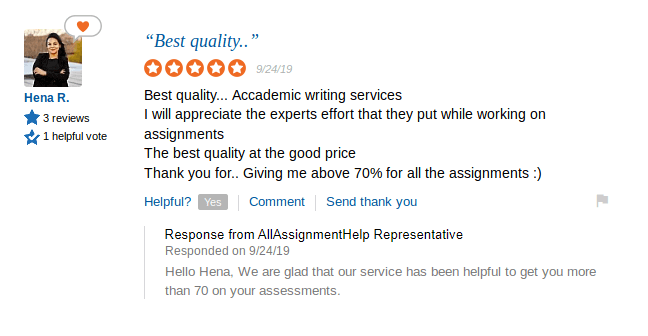

With allasignmenthelp’s affordable ACCT 3221 Income Tax Accounting I Assignment providers assistance, there’s no need to panic for students. Expert tax accounting professionals of our assignment writing help service team can take care of such papers with utmost precision and bring in good marks that students always want to attain.

Course Description

Fundamentals of federal income taxation with respect to individuals and other entities, income inclusions and exclusions, and statutory deductions in arriving at tax liability.

Please read the following information carefully. ODL is not responsible for student purchases that result in the receipt of the wrong materials. It is the responsibility of the student to order the correct textbook materials. This course is written to a specific textbook edition; edition substitutions are not allowed.

CengageNOW Access

This course requires paid access to a CengageNOW course website. We have made special arrangements with Cengage to provide an extended access period to coincide with the length of your ODL enrollment. To purchase your custom access, please follow the instructions in the “Getting Started” module in Moodle.

The CengageNOW site contains the required assignments for the course and access to a digital eTextbook.

Hardcover Textbook

You are not required to purchase a hardcover textbook to complete this course, as the eTextbook is included with CengageNOW access. Please be aware that if you purchase a hardcover textbook from any source, you should not purchase a bundle with CengageNOW access, as your access term will not be long enough for our course. You will be directed to a site where you can purchase custom 12-month access in Moodle.

Hardcover edition

William Hoffman and James E. Smith. South?West Federal Taxation 2019: Individual Income Taxes. Stamford, CT: Cengage, 2019.

Note: You must use the 2019 annual edition with this course. The textbook for this course changes editions frequently. To ensure successful completion of this version of the course, you must have the textbook for the year that corresponds with this course section. Any significant delay may result in the textbook becoming unavailable.

Ordering Information

Please review the following guidelines for ordering your course materials:

Do not purchase your materials until your enrollment is approved. During the processing period, a new section may be opened that could require a different textbook or edition.

If you are having problems locating a textbook, contact us at Answers@outreach.lsu.edu for assistance.

Thinking “how to make my assignment on Acct 3221 Income Tax Accounting I paper?” Get genuine support from industry experts at any time of the day. Our expert writers are trained and fast enough to make your assignment within 3 hours (considering the word count and criticality of the paper) when there is a concern related to immediate submission. Therefore, when you are looking for someone to “make my acct 3221 income tax accounting i assignment for me” visit our website and fill in the simple form to get the best writer to work on your assignment on IT accounting.

Other Materials and Resources

To complete the tasks for each subject, you will want a calculator. During tests, you are permitted to use a calculator, but you are not permitted to use one that can save functions or text.

When reading the required material in combination with other sources, you might want to. Although they are recommended as excellent extra texts, the following materials are not necessary for this course:

Internal Revenue Code. Old Tappan: Prentice-Hall, Inc.

This one-volume work is published yearly; use the most current edition.

Tax Guide for Small Businesses. Washington, DC: US Government Printing Office. This is published yearly; use the most current edition.

US Master Tax Guide. Chicago: Commerce Clearing House, Inc. This is published yearly; use the most recent edition.

Your Federal Income Tax. Washington, DC: US Government Printing Office. This is published yearly; use the most recent edition

Software

Adobe Flash Player, Adobe Acrobat Reader

We recommend that you do not use Internet Explorer as your web browser, as it is not compatible with your Moodle course site.

Adobe Flash Player is required for online testing and supplemental activities. Adobe Acrobat Reader is required to view PDF document files.

Hardware

Web cam with a microphone (built-in or external), headphones or working speakers, and reliable high speed internet

Exams that are proctored must be taken online and require the aforementioned gear. Before registering for this course, review the technical prerequisites on the ProctorU website and pass the equipment test. You must have a dependable, quick internet connection, and you shouldn't test utilizing an untrusted or public wireless network.

ProctorU Technical Information ProctorU Equipment Test

Nature and Purpose of the Course, Course Outcomes:

Upon completion of this course, students are expected to be able to:

- Describe the relevant tax code and regulation sections as they pertain to individual taxpayers

- Review major developments in individual taxation

- Learn how to research tax problems

- Demonstrate how income, expenses, and credit items appear on the Form 1040 and related schedules

- The "what if" game and queries that aren't related to the course material are frequently sought after by pupils. Rereading the portion of the book that addresses your issue is the best course of action if you have any. The majority of the time, the textbook has examples that are comparable to the homework problems we have chosen, so you may review that material once more.

- Your first lesson in learning about federal income taxes is income tax accounting. It is intended for accounting majors and anyone who want to understand federal income taxation's fundamental concepts in-depth. You should possess background knowledge equivalent to Intermediate Accounting (ACCT 3001) or at least be enrolled concurrently in that subject.

- The specifics of the federal income tax system will be covered in general. You will receive instruction in this extremely important and ubiquitous field of taxes by applying these tax concepts to particular circumstances. You will be required to put out serious effort in your academic pursuits.

- in creating the required problems and using the recommended reading material. The only way the course may be effectively and quickly finished is by conducting this studying on a regular and organized manner.

- Course caveat. There are many intricacies and exceptions to general rules in the tax law. This course is not designed to teach the student everything about the tax law. The objective of this course is to introduce the student to some of the general issues he or she may encounter and the corresponding tax treatment of the issue.

Working with the Course Materials

Each module consists of content, exercises, and assignments arranged under a standardized set of topics. Learn about the layout of the module. The following elements make up each module in this course: the learning goals for the module, the reading assignment, the optional CengageNOW activities, and the graded module assignment in CengageNOW. These module sections should be completed in the correct order. You should go over the directions for the course module links before starting the first module since they provide specific suggestions.

Before undertaking the module tasks, you should thoroughly go through the textbook content. In addition to a thorough and in-depth analysis of the text, this procedure should also take the drawings and examples into account. It is highly advised to quickly review the relevant textbook content after finishing a module assignment.

Recommended steps to follow in working through each module

- Read the Moodle module goals and introduction.

- To determine what subject matter is covered, browse the assigned problems and questions in CengageNOW.

- Study the allocated chapter and jot down your thoughts on the information (keep in mind that you can use three pages of notes on the exams).4.

- Employ the module's suggested study tools (Personal Study Plan).

- Visit CengageNOW and complete the problems and questions that have been given to you. Be sure to save each response and submit it after you are completed.

- Check that your assignment has been submitted to CengageNOW by going back to Moodle. This action will notify your teacher to enter your grade into Moodle.

- The optional activities, textbook information, and graded module assignments provide sufficient preparation for tests.

- You should review each module assignment after it has been graded in CengageNOW. The program will provide a detailed solution for each problem including arithmetic, if necessary. If you should have any questions, please contact your instructor through the appropriate forum or e-mail.

Suggested Study Techniques

To assist you concentrate on the material that will be covered on the CengageNOW activities, assignments, and tests, carefully read the module goals.

Try to turn in an assignment at least once every two weeks, or once each week. Assignment lateness typically causes students to lose interest and end up failing the course.

After the assignments for your module have been evaluated, go over them again, paying close attention to any criticism that was given. We advise you to hold off on submitting new tasks until you have received assignment feedback.

Review all of the module's components, including the reading, the introduction, the extracurricular activities, and the assignment, in order to be well-prepared for your tests. All the practice tools and activities in CengageNOW are accessible for you to see and complete.

Reading Assignments

Topic Outline

This course covers the following specific topics:

| Module | Topic |

| 1 | Working with the Tax Law |

| 2 | Tax Determination; Personal & Dependency Exemptions; Property Transactions |

| 3 | Gross Income—Concepts and Inclusions |

| 4 | Gross Income—Exclusions |

| 5 | Deductions and Losses—In General |

| 6 | Deductions and Losses—Certain Business Expenses and Losses |

| Examination I | |

| 7. | Depreciation, Cost Recovery, Amortization, and Depletion |

| 8 | Deductions—Employee Expenses |

| 9 | Deductions and Losses—Certain Itemized Deductions |

| 10 | Passive Activity Losses |

| 11 | Alternative Minimum Tax and Tax Credits |

| Examination II | |

| 12 | Tax Credits and Payment Procedures |

| 13 | Property Transactions—Determination of Gain or Loss and Basis Considerations |

| 14 | Property Transactions—Nontaxable Exchanges |

| 15 | Property Transactions—Capital Gains and Losses |

| 16 | Section 1231 and Recapture Provisions |

| Final Examination | |

Module Assignments

Module assignments are restricted in both CengageNOW and Moodle by completion of the previous assignment. You will have one (1) submission attempt for each assignment. However, the assignment may be completed in multiple sessions. As long as you save your answers, you may exit the activity without using an attempt. This is recommended if you spend considerable time on any exercise without submitting to avoid a timeout by the Cengage website.

After turning in the assignment in CengageNOW, you must return to Moodle and submit an assignment verification to show that you finished it. To access the next activity, you must provide these verifications. Your teacher will be alerted when you submit, and they may then move your grade from Cengage to the Moodle grade book. Your grade might be transferred by your teacher after seven days. Recognize that there will occasionally be delays, such as around holidays and semester breaks or if you turn in multiple module assignments in the same week.

In addition, you must have a grade posted in the Moodle grade book for the Module 16 Assignment in order to unlock access to the final exam. Again, please allow at least seven days for the final assignment grade to be posted in the grade book.

Confused with your ACCT2302 Principal of Managerial Accounting paper? Not to worry, our native assignment experts at allassignmenthelp are there to assist you and make your paper a high scoring one!

No need to be stressed out in case you require high scoring acct 3221 income tax accounting i assignment help service. AllAssignmenthelp.com is here to aid you with our industry leading and actual income tax professionals to make your paper high scoring.

Tax accounting assignment help service of ours is one of the best assignment assistance service considered among the students in the USA. Once you order your paper, you can relax or focus on something else as best writers take care of your paper with utmost professionalism.

Assignment Instructions

Ensure that you carefully study each question or issue and that you respond with the precise solution that it requires. For instance, when the problem asks for the tax payable, occasionally students would answer with the erroneous taxable income.

The ease and depth with which you acquire the topic rely frequently on your comprehension of earlier tasks due to the cumulative nature of the study of accounting and taxes. To complete and turn in the following assignment, it is typically not required to wait for the returned corrected version of the previous one. Once you've finished your assignment, CengageNOW offers solutions.

Recall the caveat

Reviewing the textbook and the module assignments is often the best course of action for responding to any queries you may have. Study the supplied solution carefully if after attempting the issue you are still unable to determine how to get at the solution. If the issue is still unclear to you, you may ask a question on the Moodle module forum. Questions can be answered most effectively if you can identify the specific area of difficulty. A general inquiry or request for assistance can be answered only with a general response (or reference to a textbook section), which will probably be of little assistance to you. Please do not post answers or other sensitive information in the forums.

Academic Integrity

Students in Online Distance Learning (ODL) courses must comply with the LSU Code of Student Conduct. Suspected violations of the academic integrity policy may be referred to LSU Student Advocacy & Accountability (SAA), a unit of the Dean of Students. If found responsible of a violation, you will then be subject to whatever penalty SAA determines and will forfeit all course tuition and fees.

Plagiarism

As well as creating their own modules, students are in charge of finishing and turning in their own course work. Unless outside work is suitable for the assignment, all work submitted for the course modules must be the student's own work, with any outside material appropriately acknowledged. It is also improper to utilize the teacher's version of a book, published answer keys, or to copy directly from your textbook.

Collaboration

Plagiarism is the result of unauthorized collaboration. Academic integrity rules are broken by collaborative activities that go beyond the parameters the teacher has permitted. For submission and assessment, co-op students are required to develop and compose their own unique assignments.

For more information and links to the LSU Code of Student Conduct and the SAA website, go to the ODL Academic Integrity policy page.

Exams and Grading Policy

There are three exams in this course. Exam I covers Modules 01–06, exam II covers Modules 07– 11, and the final exam covers Modules 12–16.

Before attempting the tests, make sure you have carefully gone over all of the course's previous module assignments. The tests' scope is extensive, and they will include true-false and multiple-choice questions that are comparable to those found in the CengageNOW products. The content covered in the module assignments will be highlighted in the tests, but you are also accountable for all of the material covered in the reading assignments.

The exam will only allow you three hours in total. Although you should have enough time to finish the exam, you cannot work slowly throughout this period. This is crucial since working at a slow speed is a common habit that develops when completing online projects. A good accountant must be prepared to do the task in a fair amount of time while also working appropriately and precisely.

On the test, you are permitted to refer to six pages of notes that you produced using Microsoft Word. You will need to upload your notes document to Moodle before the exam even starts. A calculator without text or function storage is also an option.

Module assignments are scored in CengageNOW, and point totals will vary. Exams are 100 points each. Your grade will be calculated out of the total number of points available.

The following grading scale applies.

97%−100% = A+

93%–96% = A

89%–92% = A-

85%–88% = B+

79%–84% = B

75%–78% = B-

71%–74% = C+

65%–70% = C

61%–64% = C-

58%–60% = D+

53%–57% = D

50%–52% = D-

0%–49% = F

You Must Earn a Passing Average On the Examinations in Order to Pass the Course.

Make It Easy With ACCT3221-Income-Tax-Accounting-I Assignment Writing Service From Allassignmenthelp - A True Friend of Yours!

We can make it too easy for you as we offer best possible solution for your acct3221-income-tax-accounting-I paper and at a very affordable cost. Without wasting any time further, order your paper and get attractive discounts on signing up with allassignmenthelp. If you are a returning customer, we have attractive offers for you as well!

Need help with your Managerial finance finc345 section 90 online assignment as well? We are there to assist you round the clock!

+1-817-968-5551

+1-817-968-5551 +61-488-839-671

+61-488-839-671 +44-7480-542904

+44-7480-542904