Introduction

In accounting, ratio analysis refers to a method that helps companies to gain insight into their liquidity, profitability, and operational efficiency by comparing financial data and information included in their financial statements. Ratio analysis stands as a cornerstone of a company’s fundamental analysis. Also, Companies use this analysis for evaluating relationships among the items of their financial statements (Delen, Kuzey & Uyar, 2013). However, these ratios are also used for identifying a company’s trends in relation to profitability, liquidity, and solvency over time or for comparing two/more companies at the same point in time. The current essay is constructed to provide a complete tutorial on ratio analysis. You can consider it as a financial accounting assignment help guide as well.

Main Body/Discussion

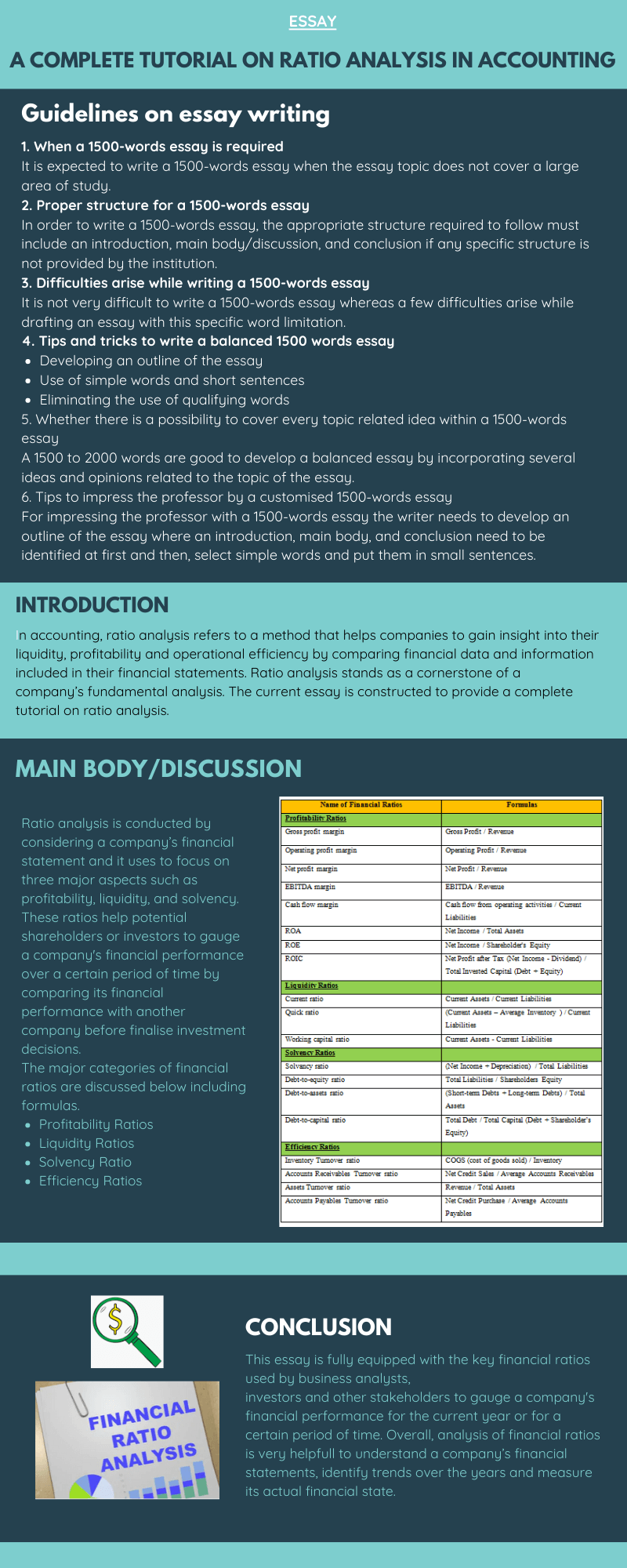

Ratio analysis is conducted by considering a company’s financial statement and it uses to focus on three major aspects such as profitability, liquidity, and solvency. In fact, these ratios help potential shareholders or investors to gauge a company’s financial performance over a certain period of time by comparing its financial performance with another company before finalizing investment decisions (Babalola & Abiola, 2013). Now, outside business analysts use different types of financial ratios for assessing companies, whereas insiders of a corporate rely less on these ratios because they have access to more detailed operational and financial data about their company.

However, this analysis involves evaluating a company’s financial performance and health by using its financial data as available in its historical and current financial statements. Sometimes, this analysis is used in order to establish a trend-line on the basis of a company’s financial results over a number of financial years i.e. reporting periods.

The major categories of financial ratios are discussed below including formulas.

Profitability Ratios

Profitability ratios refer to the financial metrics that are used by investors and analysts to evaluate and measure a company’s ability to generate profit (income) relative to its revenue, operating costs, shareholders’ equity, and balance sheet assets during a certain period of time. Also, these ratios show how well an organization uses its assets for producing profit as well as value to its shareholders. Profitability ratios are categorized into margin ratios and return ratios.

Margin ratios

This category of profitability ratios includes i) Gross profit margin that compares a company’s gross profit from the business to its sales revenue. It shows a business’s earning by taking the required costs of production into account. ii) Operating profit margin that looks at a company’s earnings (operating profit) as a % of sales before deducting income taxes and interest expenses. iii)However, Net profit margin, the most vital profitability ratio that looks at the net income (after deducting taxes and interest from operating profit) of a company and compares it to total revenue, and provides a final picture of a company’s profitability.

iv) EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin that represents a company’s profitability before taking non-operating elements like interest, taxes, and non-cash items such as amortization and depreciation into account. v) Cash flow margin that uses to express the relationship between a company’s sales and cash flows it generates from its operating activities. Also, this ratio measures a company’s ability to convert its sales into liquid cash. However, the higher this ratio, the more cash available to a company from sales which it can use to pay dividends, suppliers’ dues, utilities, service debt, and for purchasing capital assets (corporatefinanceinstitute.com, 2020).

Read Also- What is the major objective of managerial accounting?

Return ratios

In order to solve the finance assignment dealing with financial ratios in accounting, you must be well versed with the basics which go like this. i) ROA (return on assets) that represents the % of a company’s net income relative to its total assets and reveals how much profit (after-tax profit) a company uses to generate for every single dollar of assets it holds. Also, it measures a company’s asset intensity. ii) ROE (return on equity) which uses to express the % of a company’s net profit relative to its stockholders’ equity or the percentage of return equity investors can get on on the money they have invested into a company.

The investors and stock analysts use to focus on this ratio. iii) ROIC (return on invested capital) that measures the return generated by a company compared to the capital, raised from shareholders and bondholders, it has invested in its business (corporatefinanceinstitute.com, 2020).

Liquidity Ratios

These ratios measure a company’s ability to pay off its short‐term financial obligations or debts and to meet its unexpected cash requirements. Accordingly, the analysis of liquidity ratios is very important for creditors and lenders who want to get some ideas regarding a company’s financial condition before granting credit to it. In fact, the most commonly used liquidity ratios are the current ratio, quick ratio, and working capital ratio. Also, the current ratio represents the ability of a company to meet its short-term debt or financial obligations and measures whether the company holds enough resources that it can use to repay its debts in the next twelve months.

The quick ratio measures the ability of a company to meet all its short-term financial obligations by using liquid assets (cash or quickly convertible assets) it holds. Consequently, it tells about the short-term debts of a company that it can repay by selling its liquid assets at short notice to the creditors. However, the working capital ratio is used for measuring a company’s capability to meet its current financial obligations and how many liquid assets are available in a company’s hands (Brigham & Ehrhardt, 2013).

Solvency Ratio

The solvency ratio measures a company’s ability to meet its long-term debts. Moreover, it quantifies a company’s size after its tax income without counting its non-cash expenses for depreciation. It indicates a company’s solvency by judging its financial health. There are some common solvency ratios that are used for checking a company’s solvency such as debt-to-equity ratio, debt-to-asset ratio, and debt-to-capital ratio.

The debt-to-equity ratio indicates the relative proportion of debts and shareholders’ equity a company uses to finance its assets. The debt-to-assets ratio indicates the financial leverage of a company. It indicates how much of the total assets of a company were purchased or financed by its creditors. the debt-to-capital ratio measures the financial leverage of a company and is calculated by dividing interest-bearing debt (both short-term and long-term liabilities) and by the company’s total capital (all interest-bearing debt + shareholders’ equity) (Khidmat & Rehman, 2014).

Efficiency Ratios

These ratios measure the capability of a company to utilize its assets as well as to manage its corporate liabilities effectively in a short-term period or for the current financial period. Some of the most common efficiency ratios are inventory turnover ratio that indicates the movement or utilization of inventory, accounts turnover ratio which indicates how fast a company collects its dues from its customers, and assets turnover ratio that uses to measure the value of an organization’s revenue or sales relative to the value of assets it holds.

This ratio acts as an indicator of a company’s efficiency in using assets for revenue generation purposes. A higher asset turnover ratio indicates the greater efficiency of a company. Another efficiency ratio is accounted payables turnover ratio that uses to measure the faster a company repays its trade suppliers. It indicates a company’s financial condition by indicating the speed of the company’s activity to repay dues (Babalola & Abiola, 2013).

| Name of Financial Ratios | Formulas |

| Profitability Ratios | |

| Gross profit margin | Gross Profit / Revenue |

| Operating profit margin | Operating Profit / Revenue |

| Net profit margin | Net Profit / Revenue |

| EBITDA margin | EBITDA / Revenue |

| Cash flow margin | Cash flow from operating activities / Current Liabilities |

| ROA | Net Income / Total Assets |

| ROE | Net Income / Shareholder’s Equity |

| ROIC | Net Profit after Tax (Net Income – Dividend) / Total Invested Capital (Debt + Equity) |

| Liquidity Ratios | |

| Current ratio | Current Assets / Current Liabilities |

| Quick ratio | (Current Assets – Average Inventory ) / Current Liabilities |

| Working capital ratio | Current Assets – Current Liabilities |

| Solvency Ratios | |

| Solvency ratio | (Net Income + Depreciation) / Total Liabilities |

| Debt-to-equity ratio | Total Liabilities / Shareholders Equity |

| Debt-to-assets ratio | (Short-term Debts + Long-term Debts) / Total Assets |

| Debt-to-capital ratio | Total Debt / Total Capital (Debt + Shareholder’s Equity) |

| Efficiency Ratios | |

| Inventory Turnover ratio | COGS (cost of goods sold) / Inventory |

| Accounts Receivables Turnover ratio | Net Credit Sales / Average Accounts Receivables |

| Assets Turnover ratio | Revenue / Total Assets |

| Accounts Payables Turnover ratio | Net Credit Purchase / Average Accounts Payables |

Conclusion

This essay is fully equipped with the key financial ratios used by business analysts, investors, and other stakeholders to gauge a company’s financial performance for the current year or for a certain period of time. Financial ratio analysis guides investors to select the most profitable company to invest in and helps creditors and other loan-providing organizations to decide where it is profitable for them to grant loans to a company or not. Overall, analysis of financial ratios is very helpful to understand a company’s financial statements, identify trends over the years and measure its actual financial state.

Read Also- Revenue Expenditure: Full Explanation

Examples of Ratio used in Financial Analysis

There are different types of possible ratios that can be used for analysis purposes. But there is only a small core group that is typically used to gain an understanding of an entity. Such ratios include the following-

- Current Ratio: These types of ratios are used to compare the current assests to current liabilities. This happens to see that whether a business has enough cash to pay its immediate liabilities.

- Days Sales Outsatnding: These types of ratios are used to determine the ability of a business to effectively issue credit to the customers and also to be paid back on the given peiod of time.

- Debt to Equity Ratio: This usually compares the proportion of debt to equity, to see if a business has taken on too much debt.

- Dividend Payout Ratio: This is usually the percentage of earning that are paid to investors in the form of dividends. If the percentage is low, then it will be an indicator that there is no room left for the dividend payments that could increase the sustainability.

- Gross Profit Ratio: This ratio is probably used for calculating the proportion of earnings generated by the sale of goods or services., before the administrative expenses are included.

- Inventory Turnover: This is used to calculate the the time it takes to sell of the inventory. A low turn over may figure out that a business has an excessive investment in inventory, and therefore is at risk of having obsolete inventory.

- Net-Profit Ratio: This is used to calculate the proportion of net profit to sales. A low proportion can indicate the bloated cost structure or pricing pressure.

- Price Earning Ratio: This is used to compare the price paid for a company’s shares to the earnings reported by the business. An excessively high ratio signals that there is no basis for a high stock price, which could presage a stock price decline.

- Return on assests: This is used to calculate the ability of management to efficiently use assests that could generate the profits. In case there is low return then it indicated that there is a bloated investment in assets.

Most Popular FAQ

| Q1. What is ratio analysis? Ratio Analysis is done to analyze the Company’s financial and trend of the company’s results over a period of years. |

| Q2. What are the types of ratio analysis? There are mainly five broad categories of ratios like liquidity ratios, solvency ratios, profitability ratios, efficiency ratio, the coverage ratio |

| Q3. What are the 4 ways to write a ratio? You can write the ratio using words, a fraction, and also using a colon. |

| Q4. How do you write a ratio analysis report? i) Identify the audience for the report ii)Provide company background information iii) Use full financial reports. iv) Explain the financial ratios. |

If you are looking for a detailed solution on any similar topic or a detailed study guide customized specially for you, our AllAssignmentHelp.com experts can provide you with the same.