Behind the financial success of every business organization, whether it is small, medium or large in operation, scale, and size, revenue plays the most significant role. Without revenue, every business not only fails to stay in the market by continuing its regular business operations but also fails to conduct its activities related to business operations. Moreover, revenue is also referred to as sales for profit-making business organizations. It is the volume or amount of cash a company uses to bring in or earn before taking out any expenses. From the perspective of accounting, revenue consists of the amount collected by a company from the customers after selling products or services to them.

In this blog by All Assignment Help, we will read about the principle of revenue expenditure and how it is applicable to your business accounting. Moreover, we will also learn to differentiate revenue expenditure from other types of capital investments.

What is Revenue Expenditure?

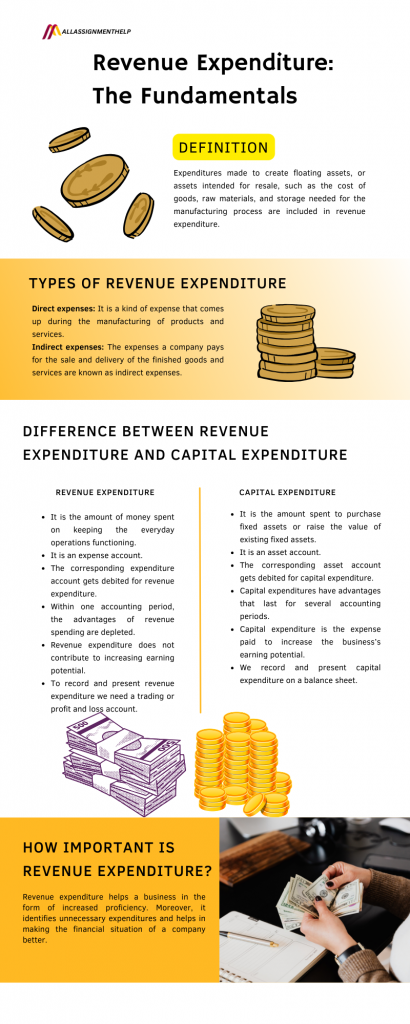

Let’s start it simple, revenue expenditure is also called operating expenses. Moreover, these expenses do not result in asset-making. Furthermore, if you are a business entity, you must know the best ways to manage these expenses. In this manner, you can ensure the sustainability and profitability of your business. In other terms, we can say that, the total of all the costs a company incurs while producing its goods and services is known as revenue expenditure.

Revenue expenditures are those that have an expense associated with them that expires within the year. It does not make a company more efficient. In addition to this, expenditures made with the intention of creating floating assets, or assets intended for resale, such as the cost of goods, raw materials, and storage needed for the manufacturing process are included in revenue expenditure. Also, everything that goes into starting a business and additional ongoing costs associated with running and managing it, such as rent, wages, taxes, etc. are revenue expenditures.

Accounting treatment

In the trading account, the direct revenue costs must be recorded. On the contrary, the profit or loss account displays indirect revenue expenditures. To determine the net profit or loss for the fiscal year, the revenue incomes are deducted from the revenue costs.

Also read: What is Marketing Management- Concept and Functions?

Types of Revenue Expenditure

This wide categorization of revenue expenditures is divided into two groups.

Direct expenses

It is a kind of expense that comes up during the manufacturing of products and services. Moreover, it includes direct pay, shipping and freight costs, import duties, rent, commission, power bills, and legal fees. Notably, direct expenses for manufacturing companies include the price of converting raw materials into final products.

Indirect expenses

The expenses a company pays for the sale and delivery of the finished goods and services are known as indirect expenses. These expenses include interest, taxation, employee pay, and depreciation. Moreover, indirect expenses include expenses for upkeep and repairs as well. Indirect expenditures help the asset work efficiently, which in turn helps the firm run efficiently, even if they have nothing to do with the finished items.

As commerce students, understanding direct and indirect expenses can be a complex deal at times. We come across many students who find finance and accounting tough, and complex to the extent that they get ideas like, can I ask someone to take my online course? If numbers and expenses are horrifying for you too, then it’s high time you seek an expert’s assistance. Because if you get stuck now, you will never come across the opportunities accounting and finance can bring to you. Hence, you can find experts online to help you overcome your academic stress so that you can focus again and better.

Also read: How Online Class Help Can Elevate Your Online Learning Experience

Difference Between Revenue Expenditure and Capital Expenditure

All companies and organizations suffer expenses for a variety of reasons. Higher revenue generation is one of these factors, and other potential explanations include financial plans for long-term business development or maintenance support. Thus, when businesses create their yearly calendar budget, they split it into two sections, expenses and revenues, which are then further split into revenue and capital components. Let us understand both the types on different parameters.

Purpose

- Capital expenditure is the amount spent in order to purchase fixed assets or raise the value of existing fixed assets.

- Revenue expenditure is the amount of money spent on keeping the everyday operations functioning.

Nature

- Capital expenditure is an asset account.

- Revenue expenditure is an expense account.

Accounting treatments

- The corresponding asset account gets debited for capital expenditure.

- The corresponding expenditure account gets debited for revenue expenditure.

Benefits

- Capital expenditures have advantages that last for several accounting periods.

- Within one accounting period, the advantages of revenue spending are depleted.

Earning potential

- Capital expenditure is the expense paid in order to increase the business’s earning potential.

- Revenue expenditure is an expense incurred in the pursuit of profits; it makes no contribution to increasing earning potential.

Presentation

- We record and present capital expenditure on a balance sheet.

- To record and present revenue expenditure we need a trading or profit and loss account.

In addition to this, if you are a finance student and balance sheets and trading accounts are tough for you or simply you couldn’t get it right regardless of how many tries you give, you must seek guidance from an expert. Moreover, do not worry about your classes, they will be taken care of. All you need to do is find an expert for your query like can someone do my online finance class for me. The expert will handle your online lectures and, in the meantime, you can make your trading account and balance sheet game stronger with the help of the subject matter experts or your subject teachers.

How Important is Revenue Expenditure?

Revenue expenditure helps a business in the form of increased proficiency. Moreover, it identifies unnecessary expenditures and helps in making the financial situation of a company better.

- Businesses may allocate resources more efficiently, cut waste, and simplify processes by optimizing daily costs.

- A company’s total efficiency may be raised through effective revenue expenditure management.

- Finding unneeded expenses is also helpful.

- For cost containment and to make sure that resources are used wisely, this is crucial.

- An organization can raise money for more important costs by cutting off non-essential spending.

- A company’s financial position is strengthened when it manages its day-to-day expenditures well.

- Companies that are able to closely monitor and manage the amount of money they spend on operations are better able to make on-time bill payments, prevent cash flow problems, and have a good outlook on their financial situation.

Also, are you struggling to manage your online exam? If yes then let the experts assist you with the same. Now, you can find experts online to take your exam on your behalf on your requests like can someone possibly take my online exam for me. Regardless of the subject, you can now hire experts online to manage your exams. Whether you are poor at time management, do not have proper technical arrangements for your online exam, do not have a stable internet connection or any other reason, nothing can prevent you from taking an exam now.

Examples of Revenue Expenditure

- Payment of wages to the factory workers.

- Cost of oil required for lubricating machines.

- Cost of power or electricity required for running a motor or machine.

- Bad debts.

- Repairs and maintenance are related to every expense incurred for improving fixed assets.

- Cost of goods that are saleable in nature.

- Depreciation expenses related to the fixed assets utilized by a company for conducting regular business operations of manufacturing.

- Interest on loan or borrowed money.

- Cost of petrol or diesel consumed in vehicles used in business.

- Cartage, freight, octroi duty, payment of insurance on the saleable goods, and cost of transportation.

- Expenses related to service charges associated with motor vehicles.

- Expenses incurred in order to conduct ordinary business activities and business administration such as printing charges, postage, insurance, rent, salaries, carriage on the saleable goods, postage, wages related to manufacturing expenses, legal expenses, commission, cost incurred for advertisement and free samples and more.

Conclusion

This was about revenue expenditure. Here we read that the continual expenses a company bears in the course of generating revenue on a daily basis are referred to as revenue expenditures. Moreover, expensed in the time in which they are incurred, these costs are associated with preserving and upholding the current level of business activities. Furthermore, both capital and revenue expenditure refers to a company’s financial resources and have different functions and traits.

Frequently Asked Questions

| Question: Explain the significance of revenue. Answer: Revenue is called the lifeline of every business organization. Besides the profit-making business organizations, revenue also stands as the most important element for non-profit organizations too. This is because revenue is the only element that not only accelerates an organization’s operations but also ensures its existence by ensuring the movement of its organizational activities on a regular basis. |

| Question: Why revenue expenditure cannot be capitalized? Answer: Due to the incapability of providing any kind of monetary benefit to the company revenue expenditures are not being capitalized and reported through a company’s balance sheet. |