We all might have encountered different risks in our lives and struggled to deal with them. However, only smart people with perfect planning can get out of those situations. Do you know that there is a concept called risk management? It is something that will help in identifying, analyzing, and controlling different types of risks. The risk management plan is an important part of risk management that helps minimize the financial risks of business and control unfortunate events. It also refers to a process adopted to monitor risk control and protect people from risky situations.

There are certain aspects you need to know about risk management plans. This blog post from the experts at All Assignment Help will provide detailed information about risk management plans. The following are the areas that will be highlighted in this discipline: So if you are a student and want to know about risk management plans in detail, then read this blog completely.

- Importance of a Risk Management Plan

- Top Risk Management Courses

- Different Types of Risks

- Five Essential Features of Risk Management

- Risk Management Framework

- What Has ISO 31000 Recommended in the Risk Management Process?

Risk Management Plan – What Is It?

The purpose of the risk management plan is to protect the capital and earnings of the company. It is the process of identifying, assessing, and controlling threats that may harm the assets of the company. Harm could occur in various ways, such as:

- Financial uncertainty,

- Legal liabilities,

- Natural disasters,

- Security threats,

- Data-related risks,

- Strategic management stress

A risk management plan increasingly includes companies’ processes for identifying and controlling threats. This includes proprietary corporate data, a customer’s information, and intellectual property. These risks, or hazards, could originate from a wide assortment of sources. These sources include:

- Money-related instability,

- Legal liabilities,

- Key administration mistakes,

- Mishaps

- Catastrophic events.

IT security dangers and information-related risks, and the hazard management systems to ease them, have turned into the best need for digitized organizations. A risk management design incorporates organizations’ procedures for recognizing and controlling dangers. This is to protect its advanced resources. For example, corporate information, a client’s identifiable data, and licensed innovation.

Additionally, you can pay someone to take your online class if you find yourself struggling with your risk management course.

Also Read: All You Need to Know About Project Management

Importance of a Risk Management Plan

Risk can arise from uncertainties in financial markets, natural disasters, legal liabilities, accidents, project failures, etc., and can adversely affect the accomplishment of an objective. A risk management plan is a necessary part of the business and helps in its proper functioning. It helps managers identify the financial risks of an organization and take effective measures to manage those risks. Furthermore, there are many other important uses of risk management plans in the business. Some of them have been listed below.

- It helps in identifying all the internal and external risks of business.

- Risk management plans help organizations be prepared and financially equipped to deal with risks.

- There are many important assets of business like labour, capital, and financial property, and risk management assists in protecting these resources and utilizing them all properly.

- A positive brand image is important for the reputation of a business organization. Every company makes different efforts to maintain its goodwill in the market. However, unfortunately, only a few of them are successful in minimizing the negative impacts of business. On the other hand, a risk management plan will not only help maintain a positive image but also improve a good brand image.

- It helps organizations keep their potential risks at acceptable levels.

Furthermore, as a student, it is highly significant for you to understand the importance of risk management as it can help you in your career. Whether you choose to finance, engineering, industrial processes, or public health, risk management is going to serve you the purpose right. Hence, you should approach experts with your requests like, can you take my online class to help me learn more about the concept? In this way, you can prepare yourself in the best manner to meet your career needs.

Top Risk Management Courses

Do you want to gain in-depth knowledge about risk management? Then you should enroll in the different risk management courses available online and offline. These courses are offered either by the top universities or by online learning platforms. If you want to learn these courses online, you should check sites like Udemy, Coursera, and Simplilearn to find a suitable risk management course related to your field. These courses are differentiated into three stages. The first is beginner, the second is intermediate, and the final one is advanced.

- Certified Enterprise Risk Management (ERM) Professional offered at the Institute of Risk Management

- Risk Management for Cybersecurity and IT Managers (Udemy)

- Learn Risk Management: Risk Planning in Agile and Scrum

- Performance Optimization and Risk Management for Trading (Udemy)

- Certificate in Financial Risk Management

- Credit Risk Management in Banking

- Introduction to Risk Management

- An Introduction to Credit Risk Management

- Quantitative Risk Management in Python

- Risk Management Tools and Practices

- Financial Engineering and Risk Management

- Investment Risk Management

- Operational Risk Management: Frameworks and Strategies

These courses will help students learn global and technical skills. If you are worried about who is eligible to take these courses, then let us clear it up for you. Anyone who has completed their 12th-grade studies, working professionals, or entrepreneurs can take these online courses and learn more about risk management departments. Moreover, as a student, you may also get assignment help online and earn highly valued academic scores.

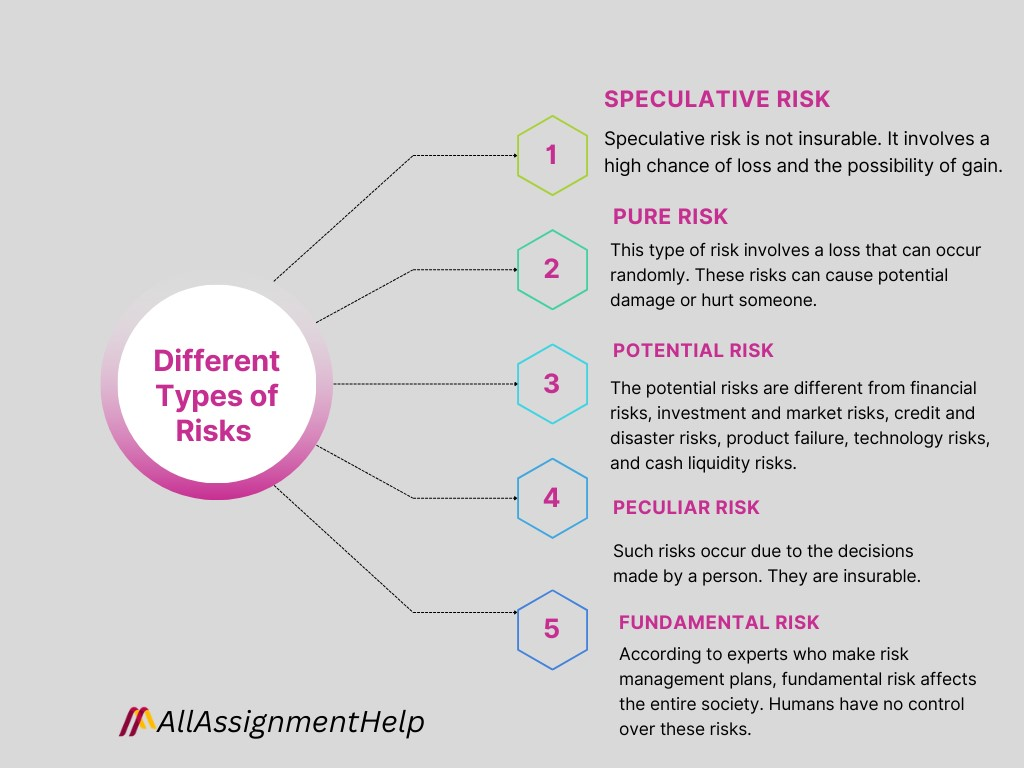

Different Types of Risks

Risks are classified into four types. They are speculative risk, pure risk, fundamental risk, and peculiar risk. You can read more about these risks in the information given below. In addition to its meaning, we have also listed a few examples of this risk to help you understand these concepts in detail.

Speculative risk

Speculative risk is not insurable. It involves a high chance of loss and the possibility of gain. Here are a few examples of speculative risk:

- Stock exchange,

- Gambling,

- Investments in landed property,

- Import and export trade

Pure risk

This type of risk involves a loss that can occur randomly. These risks can cause potential damage or hurt someone. Insurance companies often cover these kinds of risks. Examples of speculative risks are:

- Fire

- Theft

- Death

Fundamental risk

According to experts who make risk management plans, fundamental risk affects the entire society. Humans have no control over these risks. Examples of fundamental risks are:

- Earthquake,

- Windstorm,

- Hailstorm,

- Typhoons,

- Cultural change and many more

Peculiar risk

Such risks occur due to the decisions made by a person. They are insurable. Examples of peculiar risks are:

- The decision to buy a car

- Build a house,

- Go to a particular university, etc.

Also Read: 8 Best and Unique Ways for Time Management

Potential risk

The potential risks are different from financial risks, investment and market risks, credit and disaster risks, product failure, technology risks, and cash liquidity risks. You can see that different companies have different internal risk control components. These components are

- Objective setting

- Risk assessment

- Risk Control

- Monitoring, and so on.

These components are for:

- Recognize and categorize threats.

- Evaluate the vulnerability of the risks.

- Identify ways to lessen the effect of threats.

- Implement the best strategy to mitigate risks.

- Monitor the effectiveness of risk management efforts.

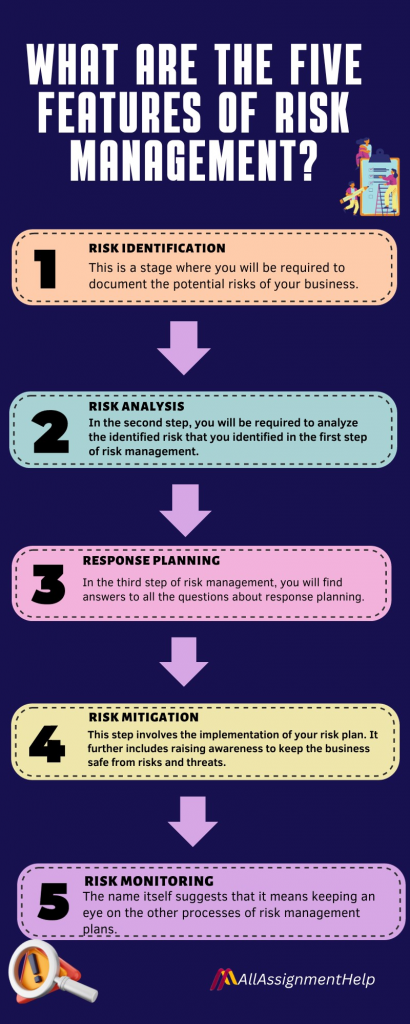

What Are the Five Features of Risk Management?

Effective risk management covers five features. These five features help the organization identify all kinds of risks and prevent them from getting worse. Moreover, as a student, you should excel at it all. This is not only for exam purposes but for career. However, if you find yourself struggling with learning about the features, it can be troublesome as it can prevent you from getting good grades. In such situations, thoughts like, can I hire someone to take my online exam, can come to light.

Therefore, by hiring online class tutors for help, you may earn A grades in any of your complex courses. Let us now take a look at the five important elements of a risk management plan.

- Risk identification: This is a stage where you will be required to document the potential risks of your business.

- Risk analysis: In the second step, you will be required to analyze the identified risk that you identified in the first step of risk management.

- Response planning: In the third step of risk management, you will find answers to all the questions about response planning.

- Risk mitigation: This step involves the implementation of your risk plan. It further includes raising awareness to keep the business safe from risks and threats.

- Risk monitoring: The name itself suggests that it means keeping an eye on the other processes of risk management plans.

Types of Risk That Management Should Consider While Making a Risk Management Plan

There are different types of risks, and management must be aware of all of them to be successful in the long run. The following are some of the risks that, as a manager of an organization, you should be careful of:

- Financial Risk

- Credit risk and investment risk

- Market Risk

- Reputational Risk

- Operational Risk

- Process Risk

- Human Risk

- Legal Risk

- Compliance Risk

- Strategic Risk

- Security Risk

- Human Risk

- Physical Risk

Another important risk category is third-party risk. It refers to the potential risk that arises from organizations relying on outside parties to perform services or activities on their behalf. Each of these risks is different from the others. However, these are essential parts of the business. There would be no organization in this world that could say that they are far away from risks. But yes, the best one out of them is the one that makes an effort to adopt a risk-based approach and has timely control over risks. Further, in this blog post, we have discussed many factors that will help companies manage their risk activities.

What Has ISO 31000 Recommended in the Risk Management Process?

ISO 31000 is an international standard that provides different guidelines for effective risk management in business. ISO 31000 Risk Management has issued certain target areas and principles that would help organizations to effectively manage all their business risks and threats in the long term. The main aim of ISO is to provide clear guidance to organizations on risk management. This guideline can be used by any business for its benefit. There is no restriction based on size, activity, or sector.

The ISO measures have been created worldwide to help associations deliberately execute best practices in chance administration. A definitive objective for these benchmarks is to set up normal structures and procedures to viably actualize hazard administration techniques. These benchmarks are perceived by universal administrative bodies or target industry gatherings from time to time. They are likewise consistently supplemented and refreshed to reflect the rapidly changing wellsprings of business hazards. Although following these measures is normally deliberate, adherence might be required by industry controllers or through business contracts.

The ISO recommended that the following target areas, or principles, should be part of the overall risk management process.

- The procedure ought to provide an incentive for the association.

- The process should be a vital piece of the general authoritative process.

- It should factor into the organization’s basic leadership process.

- It should expressly address any vulnerability.

- The process should be deliberate and organized.

- It ought to be founded on the best accessible data.

- It ought to be custom-made for the venture.

- The process must consider human variables, including potential mistakes.

- It ought to be straightforward and comprehensive.

- It ought to be versatile enough to change.

- This process must be ceaselessly observed and enhanced.

Eleven principles of effective risk management

In addition to the above principle, the following eleven principles will help in the effective management of business risks.

- Risk management helps in creating and protecting different important business values.

- It is an integral part of all organizational processes and helps in the promotion of

- Risk management assists in making the right decisions at the right time.

- Uncertainties are part of business, and risk management addresses all of them.

- All the principles of risk management plans are systematic, structured, and timely.

- Every organization should make sure to prepare its risk management plan with the best and most important information about its businesses.

- You must ensure that you include human and cultural factors in your management plans.

- Anyone can alter their risk management plan as per their requirements.

- Transparency should be the key factor in risk management.

- The main benefit of risk management is that it helps in the regular improvement of organizations by removing all kinds of risks.

- A risk management plan can be responsive to change.

Also Read: Things to Ponder About Human Resource Management

Risk Management Framework (RMF)

The design of the framework is a further development of the risk management policy into a concrete risk management plan for the organization. It is elaborated by the appropriate managers, e.g., the chief risk manager and his or her team. Each plan should be tailored to the organization and its context, including its risk profile, culture, sector, etc. It is comprehensive work, certainly for larger companies, and a huge task when this is accomplished for the first time. However, there is no right or wrong in this, as the process of continuous improvement embedded in the framework will cover the shortcomings of the initial issues. The most important part is to start making a plan for the implementation of the risk management policy in the organization.

This plan ideally discusses the following issues and subjects:

Understanding the Organisation and its Context

Before making up a risk management plan for the organization. It is a good practice to arrange a gap analysis, investigating the current situation and working on risk management and its principles, and what is still missing. This view of the internal context can then be further developed by indicating the governance structures to which risk management needs to be matched.

The organizational context also includes its objectives, strategies, and policies, as well as the knowledge, skills, and resources regarding the implementation of risk management in the organization. What is missing regarding resources, knowledge, and skills, and how can this deficiency be overcome? Another question is, What are the implications concerning the organizational culture? What are the contractual relationships with other stakeholders, and how do you fit them in? These are also issues to be addressed in the plan.

However, it is also important to understand the external context in which the organization seeks to pursue its objectives. What are the current trends and key drivers in the sector? What are the perceptions and values of key external stakeholders?

Establishing the risk management policy (on an operational level)

Understanding the context is what is needed to develop the risk management policy and what is needed to document its components even further, giving answers to any question that can be posed regarding the implementation of risk management in the organization:

- What are the rationale and objectives regarding the implementation of risk management?

- How do you manage conflicts of interest?

- What are the accountabilities and responsibilities of managers?

- What are the resource commitments?

- How to manage risk management performance

- What is the reporting, delegation, and escalation process, and how do I execute it?

- What is the procedure and time cycle for the review of the plan?

- How do I communicate the plan?

These are just several questions that need to be clarified by the policy. Elaborate on these in a plan on an operational level.

Designating Risk Owners for Identified Risks and Determining Their Accountability

The organizational arrangements of the framework also include the identification of risk categories and the designation of related risk owners at the executive level. It also establishes the board of directors’ accountability for the framework’s implementation. Therefore, it is necessary to identify the accountability of the risk owners for all aspects of the organization. For every risk at the strategic level, specific performance indicators and measurement processes can be put in place. Dedicated and delegated risk owners also need to find clear reporting, delegation, and escalation process instructions in the plan.

Establishing How to integrate risk management into all organizational processes

The management of risk should be part of all routine and organizational processes, such as policy development, business and strategic planning, change management, and any of the other decision-making processes in the organization. The risk management plan should therefore answer how to use risk management to make decisions for all of these processes, in line with the risk management policy.

Determining the resources to implement the plan and integrate risk management throughout the entire organization

Implementing risk management on a holistic scale will require a substantial amount of resources. including the people, skills, experience, time, and funds needed to close the gap and implement all steps of the risk management process in all organizational processes.

Together with these resources, one can also put forward processes, methods, and tools, as well as the kind of information systems. An organization needs resources to accomplish the effort to build awareness about risk management and for the education of managers, including the planning of training programs for the entire organization.

Establishing Internal Communication and Reporting Mechanisms Regarding the Management of Risks

To be transparent and inclusive, it is important to establish internal risk management communication and reporting processes and mechanisms. Organizations need this to monitor and manage risk management performance, but also for the execution of delegation and escalation processes.

Establishing External Communication and Reporting Mechanisms Regarding the Management of Risks

Another consequence of this is the need to develop a plan. The plan should describe how the company intends to communicate with its external stakeholders. Communication is important regarding its risks and the management of these risks.

Conclusion

Moving towards the conclusion, we would recommend you all opt for the risk management course, learn everything in detail, and develop your knowledge. This course has great scope in the future. If you are worried about which risk management courses are best to pursue, you may refer to this write-up. This blog is a power pack of information, and here you might get an idea of the various intricate areas of risk management. Further, we have discussed the risks involved in business, the features of a risk management plan, and the standards for risk management plans as set by ISO.

About Us

Are you having difficulty dealing with your value-risk management assignment? Do you look forward to getting help? Yes, you may visit All Assignment Help and get assistance with all of your risk management assignments. In addition to risk management, our experts can assist with other courses like financial management, foundations of financial management, strategic management and policy, managerial finance, and many other courses. No matter which subject you have difficulty learning, you may reach out to us and get the help you need to complete your degree with good credits.

Frequently Asked Questions

| Question 1: What are the five features of a risk management plan? Answer 1: They are risk identification, risk analysis, response planning, risk mitigation, and risk monitoring. |

| Question 2: Can AI be used in risk management? Answer 2: For many years, manual risk management has been practiced by all of us. But now that Al is in charge, manual risk management is no longer necessary. The corporation can use AI to address all of its financial issues. |

| Question 3: What does a risk management plan include? Answer 3: A risk management plan includes methodology, a risk register, a risk breakdown structure, a risk assessment matrix, a risk response plan, roles and responsibilities, funding, and timing. |