Accounting is one of the fastest-growing careers in today’s time. If we look at 7, out of 10 students choose accounting as their career path. There is a common assumption that accounting and commerce are much easier than science. But the actual case is different. Both are completely different fields and unique in their way. Many students, for instance, have a difficult time dealing with accounting problems, which is completely understandable. The average cost method is also a popular name among accounting students. However, they must be well aware of this accounting term. If not, they can get an in-depth analysis of what the average cost method is.

Therefore, this blog is brought to you by Allassignmenthelp.com to provide a detailed explanation of this cost method.

What Is the Cost Accounting System’s Background?

The rapid growth of the industrial revolution has instigated the need for developing cost accounting in businesses. Before industrialization, most business organizations were small and medium in size. However, they operate their regular business by using conventional accounting systems for accounting purposes. For instance, they were not aware of a separate accounting system that could assist them to measure and analyse costs separately. Often, the era of the industrial revolution turned the face of business organizations. Therefore, this is in respect of operations, scale, and structure.

Further, business organizations have grown and developed vastly and this increased the complexities of business operations. Eventually, in large business organizations, the need for tracking costs becomes crucial for successful and hassle-free business operations. Therefore, these complexities in the business environment instigated the need for effective management. This accordingly became the main reason behind the emergence of the cost accounting system.

Also Read: Cost Benefit Analysis: Your path towards Success

How Does the Average Cost Method Work, and What Exactly Is It?

The need of improving the management systems and business activities of large and medium-sized companies. Therefore, it has provoked the evolution of the cost accounting system. Cost accounting, however, is a branch of accounting. However, that solely involves collecting, analyzing, recording, summarising, interpreting, and reporting financial data and information of an organization. Therefore, over the passing time, several arms are added to this accounting system. One of them accordingly is the average cost method. It refers to a method of inventory costing. The cost of each item in a company’s inventory is calculated using this method.

Furthermore, the average cost method is calculated by dividing the total cost of items (goods) in inventory by the total unit of goods, present in the total inventory, available to the company for conducting sales activities. However, this method is also known as the weighted average method. Under this method, the cost of inventory is assumed based on the average cost of goods available in a company’s hand for sale during a particular period.

The Average Cost Method’s Definition and Goals

The average cost method, therefore, is a method of calculating the cost of inventory. To calculate the average cost of inventory, the total cost of inventory and the number of items or units present in the total inventory are considered. Moreover, the average cost method is a process of assigning relevant costs to each item in inventory at the time of selling such inventory item. Some business organizations choose to apply the average method rather than using other inventory valuation methods such as LIFO (last-in-fast-out) or FIFO (first-in-first-out). It’s all because the average cost method uses to minimize the drastic and sometimes negative effects of allocating costs on the inventory items based on the item’s value on the date of purchase.

Also Read: Cost accounting: Detailed explanation

Description and Formula of Average Cost Method

A company that offers products and services to customers needs to deal with inventories. A company offers products to the final customers by either purchasing the same from one of two manufacturers of the products or produced by it. The items of inventory of a company that is sold are recorded as COGS (Cost of Goods Sold). Therefore, the CoS is a fundamental element for companies, investors, and trade analysts. Gross margin stands at first in the line of profit of a company in its income statement. For instance, calculating the total COGS to consumers for a particular period, different types of companies use different types of methods to calculate the cost of their inventory.

Briefly, there are three types of inventory costing methods such as First-In-First-Out (FIFO), Last-In-First-Out (LIFO), and Average Cost method. The average cost method, however, or the weighted-average inventory costing is a method of costing where the cost of ending inventory is calculated by using the weighted-average cost per unit of inventory. Therefore, the average cost method is much more acceptable in today’s complex business environment for calculating the cost of inventory.

First-in-first-out

For instance, the First-in-first-out (FIFO) method uses to assign costs to a company’s inventory that is sold based on the date of the first purchase of inventory. Hence, under the FIFO method, the product purchased first is sold by the purchasing company first in comparison to the other products.

This method, for instance, overstates a company’s levels as inventory and its price continues to rise. However, this is only the high-priced inventory that is purchased after the date is presented in the company’s annual balance sheet. This is because the first purchased item of inventory, purchased at a lower price, is sold out first.

Last-in-first-out

On the other hand, the Last-in-first-out (LIFO) method is opposite to FIFO and creates an opposite effect on a company’s balance sheet. Under this method, the last purchased inventory items are sold out first than others. Therefore, this particular method understates the level of inventory and constitutes net income at a lower value for the financial period. However, the average cost method stands as a middle ground between LIFO and FIFO. Consequently, the two conventional methods of inventory valuation. For instance, this method uses to calculate the average cost of total inventory in hand and utilizes that cost as the selling price of such inventory.

The formula of the average cost method is as follows –

Average Cost Method = Total cost of goods in inventory (available for sale) / Total units available

Reasons Why Is the Average Cost Method the Right Choice for Organizations?

The application of the average cost method. however, needs little labour and is considered the least costly method of inventory valuation. In addition, it is the simplest method of inventory valuation and trustworthy. Therefore, the company’s income cannot be manipulated if it often uses the average cost method to evaluate its inventory value. In the case of using other inventory costing methods, there are consequently some grounds to manipulate income figures easily by calculating inventory costs in a manipulated way. Meanwhile, a company that sells indistinguishable products or products that are difficult to differentiate from each other often found it tough to compute the cost attached per unit of such product. And, therefore, to overcome this problem the company prefers to apply the average cost method.

Furthermore, this method helps a company track every single product when it operates by moving huge volumes of almost identical products through inventory. As well as consistently following the same during the accounting periods, companies that adopt this particular inventory costing method must stick to it for the upcoming accounting periods. On the other side, therefore, a company is free to change its inventory costing method from the average cost method to any other cost method in such a case. Therefore, the company needs to reflect such change through its financial statements for its investors and other stakeholders.

Ways to Calculate Average Cost Method

As the name says, the average cost method uses to price items lying in a company’s inventory. For instance this, it considers the average cost of every similar product or item available in the company’s hand for sale. However, the process of calculating the weighted average cost of inventory is helped with an example provided below.

Likewise, the below-stated example shows the average cost method of valuing inventory. Therefore, it is assumed that the company has conducted the following transactions in its first month of business operations.

| Date | Purchases (Units) | Rate (per unit) | Sold/Issued (Units) | Balance (Units) |

| 01-05-2021 | 2,000 | @ $4.00 | 2,000 | |

| 15-05-2021 | 6,000 | @ $4.40 | 8,000 | |

| 19-05-2021 | 4,000 | 4,000 | ||

| 30-05-2021 | 2,000 | @ $4.75 | 6,000 |

Further, to help you understand, the above data was derived from a fictitious company. The weighted average cost method is calculated using the inventory method, COGS (cost of goods sold), and ending inventory.

| Invoice Date | No. of Units | Cost per Unit |

| 01-05-2021 | 2,000 | $4.00 |

| 15-05-2021 | 6,000 | $4.40 |

| 30-05-2021 | 2,000 | $4.75 |

| Total Inventory | 10,000 | |

| Weighted Average Cost of inventory (per unit) = $43,900/10,000 = $4.39 | ||

| Inventory in units (Closing Inventory) = (10,000 – 4,000) * $4.39 = $26,340 | ||

| Cost of goods available for sale | $43,900 | |

| Less: Closing inventory | 26,340 | |

| Cost of goods sold | $17,560 |

If the company has opening inventory, it is included in the total available units for sale as well as the total cost of goods available for sale when calculating the per unit average cost of inventory. If you face difficulties in dealing with your accounts problems, then you can pay someone to do your homework.

The Different Types of Average Cost Methods That Are Oftenly Used

The average cost method is consequently divided into two types. However, they are:

- Simple weighted average cost method

- Perpetual weighted average cost method

Therefore, let us understand these two methods briefly:

1- Weighted average cost method

In accounting terms, the weighted average cost method, therefore, is an inventory method that identifies the average weight of the cost of goods sold and inventory. However, the inventory cost at the end is calculated with this method. As a result, it’s computed by dividing the cost of goods for sale by the number of units available for purchase.

2- Moving weighted average cost method

A moving average cost, therefore, is a method is an inventory method that calculates the average unit cost of all the units. This method is difficult to use, but it provides you with an accurate price and value for your company. It can be calculated by dividing the overall cost of purchase by the total cost of sales of goods.

Advantages of Average Cost Method

Consequently, the average cost method is one of the most widely used methods for determining the value attached to the cost of goods sold and assigning costs to each item in inventory. Therefore, this method is used in both perpetual inventory and periodic inventory systems.

Furthermore, there are several advantages of applying the average cost method for calculating inventory and these advantages make this method one of the most popular methods of inventory valuation among the other methods. However, the following are the benefits of using the average cost method.

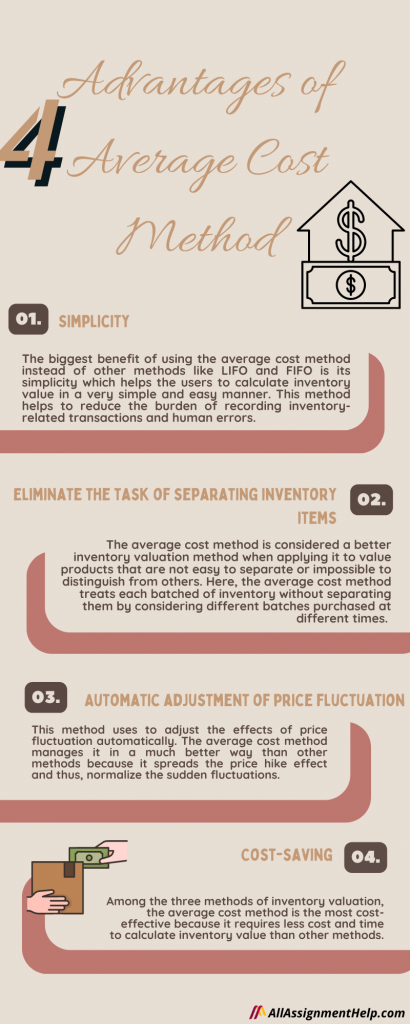

Simplicity

The biggest benefit of using the average cost method instead of other methods like LIFO and FIFO is its simplicity which helps the users to calculate inventory value in a very simple and easy manner. This method also simplifies the process of record-keeping as well as simplifies the processing of inventory ordering even if the company operates with a high frequency of inventory ordering.

In addition, bookkeepers do not keep the track of every single batch of inventory bought in along with its respective purchase price and it creates the chances of errors. However, this method helps to reduce the burden of recording inventory-related transactions and human errors.

Furthermore, the average cost method is the simplest process of tracking inventory expenses. While retrieving the units, the company does not need to track the original cost of inventory before pricing it to make it available for sale. It helps users, however, to mark up the average price of units and this makes picking and pricing inventory easy.

Eliminate the task of separating inventory items

The average cost method is considered a better inventory valuation method than LIFO and FIFO when applying it to value products that are not easy to separate or impossible to distinguish from others. For instance, iron ore, wheat, oil, etc. always purchased in batches are some products that are not possible to separate one batch from another. Hence, the average cost method treats each batched of inventory without separating them by considering different batches purchased at different times. Therefore, this method is much more relevant and suitable for companies to operate by using these kinds of inventories.

Automatic adjustment of price fluctuation

This method is thus used to adjust the effects of price fluctuation automatically. For example, assume a company has closing inventory from the last batch purchased when prices increased unexpectedly. However, this method normalizes the price by the fluctuation in it. Because it spreads the price hike effect and thus normalizes the sudden fluctuations. In this case, the average cost method manages it much better than other methods.

Cost-saving

Moreover, among the three methods of inventory valuation, the average cost method is the most cost-effective. However, it requires less cost and time to calculate inventory value than other methods. Sometimes, because labour cost stands as a vital expense in every company, reducing the time spent on valuing inventory is cost-effective for the company as well as frees up the employees of the company to focus on other tasks. This labour cost savings along with efficient utilization of time offset the potential losses which use to occur as a result of computing the value of expensive inventory items at a price similar to the low-cost items.

Furthermore, I hope the benefits listed above demonstrate why the average cost method is superior to business methods. It can be simple to understand things theoretically for students, but putting them into practice can be difficult. Hence, Are you having trouble dealing with your cost accounting problems?. If yes, then you can seek help from “do my assignment” online services at any time.

Also Read: What is the major objective of managerial accounting?

About Us

All Assignment Help, however, is a leading assignment writing website that can help students with their coursework and assignment writing. However, with years of experience, we have proven ourselves to be the best in this industry. It has been all possible because of our talented assignment writers who always produce the students with top-quality assignment solutions. Thus, All the professional experts on our website are PhD. holders with great knowledge and experience. However, they can assist the students with their assignments in all possible ways.

Are you a student studying in the USA, UK, Canada, Singapore, or in any part of the world? Hence, Are you facing problems in writing your assignments? You can take advantage of the “do my homework” services in that case and solve your problem. Therefore, we can help you with your assignments and can assist you in scoring good grades.

Frequently Asked Questions

| Ques: What is the formula for calculating the average cost method? Ans: The average-cost technique, also known as the weighted average cost method, is a method of calculating inventory value in accounting. To arrive at this value, the total cost of products is divided by the total quantity of items throughout a specific accounting cycle. |

| Ques: What is the average cost of supplies? Ans: The cost of supply (CoS) helps to find the cost imposition of various customer categories. The cost to a utility of delivering one unit of electricity to a customer’s metering point is called the cost of supply in terms of electricity. It also gives detailed cost information for functionality that has been functionalized, classified, and assigned to diverse customer groups. |

| Ques: What is the difference between average and marginal cost? Ans: The marginal cost is the difference between the total cost of adding a new product and the total cost of not adding it. The total output is divided by the total cost to arrive at an average cost. |

| Ques: What are the different steps of an accounting cycle? Ans: The accounting cycle consists of eight steps. They are transactions analysis; entering all the transactions in the journal; posting them into the ledger; unadjusted trial balance; adjusting the entries of trial balance; preparing the financial statements, and the closing of all the books and accounts. |