Cost accounting is a branch of accounting that has been in use by business organisations for a very long time. This indeed is the best way to keep track of the costs and activities of any and every kind of non-profit and profit-making organisation. It is termed a managerial accounting process that includes many tasks related to costs like; recording, analyzing, allocation of business-related expenditures and reporting any company’s costs. Through this companies can figure out the ways they reduce their spending. It computes the cost of a product or service by considering every factor contributing to the process of producing such product or service which includes the factors related to manufacturing or production and administration.

A cost accounting system is aimed at helping a company’s management to fix the final price of a product or service it produces. Moreover, it detects every sort of waste, defects, and leakages during a company’s manufacturing process as well as its marketing processes. It is a highly significant and advantageous companion to traditional financial accounting systems. As it is a complex subject students struggle a lot with its concepts and terminologies. This blog by allassignmenthelp has covered all the basics related to this topic to help students understand it better. There are also ways and techniques they can use to deal with their cost accounting assignments or any academic tasks.

Explore the Origin of Cost Accounting

Prior the Industrial Revolution, business organisations were small in size and they were characterized by simple exchanges between organizations and individuals. In that period, accurate accounting or auditing was needed but nobody gave importance to cost accounting. Over the years businesses became complex due to their distinct operating activities and this called up the need for this as the Industrial Revolution resulted in the development of large-scale organisations and businesses which were much more dynamic. Hence, this shed light on this topic and this was from where it originated.

The concept of cost accounting originated and evolved to help businessmen track their expenses and costs by keeping a record. Before this golden era, the costs and expenses used to be categorized as variable costs which included:

- Cost of material

- Labour

- Overhead, and

- Other variable costs.

However, at the time when industrialisation came into existence, businesses had several ‘fixed costs.’ These were not directly associated with the manufacturing or production of products or services. However, these fixed costs consist of expenses related to rent, storage costs, depreciation, insurance costs and more. As the steel industry, railroads and some other large industries were developed with time, the understanding of the fixed costs in businesses became important. With this, the allocation of these fixed costs became significant to the business owners and managers for their business-oriented decision-making, product development, and pricing. Hence the concept of modern cost accounting originated.

Also Read- How To Write An Accounting Dissertation?

What is Cost Accounting and its Objective?

Cost accounting is an accounting process that is for recording all types of costs incurred by a company or organisation for conducting their business operations in such a way which can assist in improving its management. It is a process of collecting, classifying, recording, analysing, summarising, and then, allocating costs that are associated with the operational processes of an organisation, and then developing a set of actions for controlling those costs. It is a method of accounting that aims towards capturing the costs of a company’s production process by assessing the input costs related to each step of the company’s production process and fixed costs like depreciation of tangible assets and amortisation of intangible assets.

With the application of a cost accounting mechanism, a company become able to measure different types of costs first and then record them individually and after that compare the input and output (actual) results to aid its management in measuring its financial performance. A vital part of this accounting system involves the unit cost of products for reporting the COGS (cost of goods sold) of the manufacturer’s income statement and inventory cost in the balance sheet. It also helps the management in preparing a capital budget for the company concerning business expansion. It includes some special analyses like cost behaviour analysis, CVP (cost-volume-profit) analysis, decisions related to making or buying, final selling prices of products, and more.

Main Objectives of Cost Accounting

For instance, a bank uses cost accounting to determine the processing cost associated with its customers’ deposits and/or checks. The cost of maintaining the account, servicing costs related to mortgage loans, processing costs for international or domestic fund transfers and more. This, in turn, provides guidance to the management of the bank in setting the proper price for the various services it provides to the customers or clients. The objectives of this system are to ascertain the per unit cost of different types of products a manufacturing company uses to manufacture. And, to provide correct cost analysis of business operations. Along with different cost elements concerning the regular operating activities of a business concern. It is also aimed to disclose the sources of production-related wastages such as wastage of raw materials, time, and funds.

Another objective of a cost accounting system is to provide requisite data and information to the management of a company as guidance to set the best possible price for the final product. Furthermore, this particular accounting system’s other objective is to ascertain the profitability attached to each product and service produced by a company and advise the management regarding the way to maximise such profitability.

Why Cost Accounting is Beneficial For Students?

There are a lot of benefits that students, especially commerce students get by understanding Cost Accounting as much as they learn about Financial Accounting. One thing that they should keep in mind before moving ahead with the subject, you understand what value it holds. This particular topic not only holds importance in one’s life but in various business management tasks. They are very beneficial for students and if they are stuck in between they can always get cost accounting assignment help from experts.

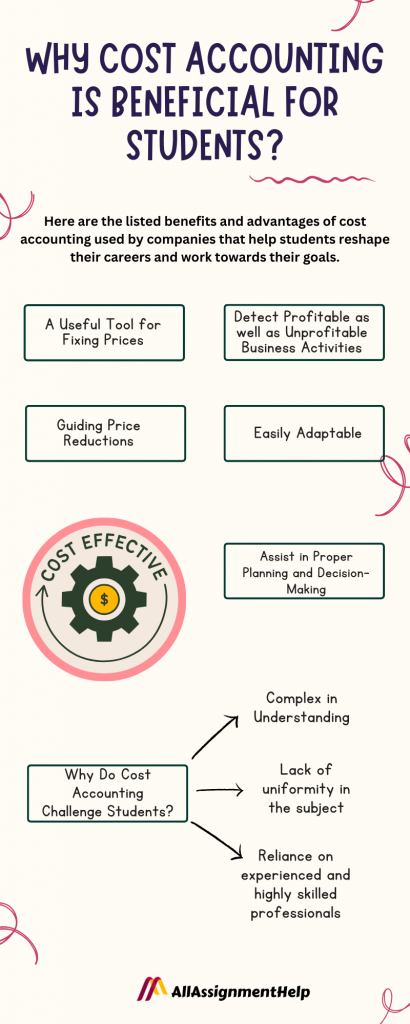

Here are the listed benefits and advantages of cost accounting used by companies that help students reshape their careers and work towards their goals.

A Useful Tool for Fixing Prices

A company, in some cases, is capable of fixing up the final price for the product. This is the one that it ought to sell in the market as per the cost incurred for producing such products. Here, it becomes difficult to fix a product’s final price properly if there are no proper cost figures. For Example, if the final price of a product is fixed without using proper costing. Then, the quoted price of such product won’t be accurate as per the actual production cost of that product. Moreover, if the final price of a product stands higher than the production cost then a company loses its customers. And, if it stands lower than the production cost then the company faces loss.

Therefore, the cost accounting system reveals the exact price to be charged to customers. This would be profitable for the manufacturing company. Manufacturing companies use cost accounting systems to get accurate information about the costs incurred for manufacturing a product or service they deliver to customers. Hence, students should be aware of this benefit and importance of learning this topic.

Detect Profitable as well as Unprofitable Business Activities

This accounting system detects profit-generating business activities that are required by a company to get constant profit from the market. Besides this, it also detects the unprofitable business activities that result in creating negative pressure on gaining profit and helps the management to eliminate such activities. If students master this, they have a lot of opportunities in this field. To explore this further, you can take activity-based cost accounting assignment help from experts. They can help you with such situation-based problems and help you enhance your skills.

Guiding Price Reductions

In some situations like a downturn, it becomes very important for a company to reduce the final price of its products, even below the products’ actual total cost. This is also known as predatory pricing in which a company sets up a pricing strategy where they intentionally set the price lower than their competitor to attract customers and drive the competitor out of the market. In this situation, properly ascertained costs guide the management of a company to reduce the final price of products to cope with the situation

Easily Adaptable

Managers appreciate this system because it is easy to adapt and implement following the changing needs and demands of a business. Unlike the static financial accounting system, driven by the Financial Accounting Standards Board (FASB), the cost accounting system is only concerned with internal purposes and the internal eyes of a company’s management board.

Assist in Proper Planning and Decision-Making

A cost accounting system helps the management to set financial budgets. And, conduct variance analysis both of which are very important for making proper business plans. It facilitates the management by providing them with detailed information regarding available labour and machine capacity. In this way, it helps in setting proper work plans so that no department remains idle. And, also no one is overworked. However, it also assists in preparing the annual financial budget. And, capital budget which are very significant for proper fund allocation and business expansion. It guides management to make decisions regarding the use of labour and machines. This is for production by indicating the profitability of using both of these or any one of these for production

Also Read: What is the major objective of managerial accounting?

Why Do Cost Accounting Challenge Students? Unveiling the Complexity!

As this is a very complex subject, there are many challenges attached to it. This makes it difficult for students to understand the concept and terminology. To ease that they take expert assistance as the subject is equally important for them for a better future. Here are a few challenges that students face:

Lack of uniformity in the subject: This particular accounting system does not include a uniform process. It often makes different cost accountants generate separate results from the same data and information. Due to such limitations, the results of cost accounting are used as estimates only.

Complex in Understanding: This accounting system is quite complex to apply in comparison to a financial accounting system as it requires lots of work on the front end, along with some constant adjustments for improvements. Segregation of different types of cost elements by considering their nature is also responsible for making this system more complex than other accounting systems. Hence if you want to explore, financial accounting definition, objectives, qualities, and financial statements, you can always learn about it.

Reliance on experienced and highly skilled professionals: The application of a cost accounting system requires highly skilled professional accountants and auditors. So, students also need expert assistance to understand the overall concept. After the students get placed or are in an internship they need to get extra training as an employee as well as gain the capability to cooperate with the data input sufficiently. Hence, in such a situation, all they do is get cost-benefits accounting assignment help from experts.

Closure

In conclusion, cost accounting is an important branch of accounting that helps businesses track and manage their costs effectively. It plays a pivotal role in determining product prices, detecting wastage, and guiding decision-making. While it offers numerous benefits to students and businesses alike, its complexity can pose challenges for students. Understanding cost accounting is essential for students pursuing careers in finance and business management, and seeking expert assistance can be a valuable resource to overcome the intricacies associated with this subject. Whether it’s assignments, essays, dissertations, case studies, or homework, students have access to a wide range of professional assistance to master cost accounting concepts and excel in their academic and professional endeavours.

Insights on Us!

Allassignmenthelp.com is one of the leading websites providing assignment help online to students. We have a team of qualified experts who cover almost all the disciplines. We aim to help students to get competitive scores in the assignments they get from the college. To fulfil our aim, we have kept great discounts and benefits for students like.

- Discounts and cashback on assignments

- Low-cost academic paper writing service

- Plagiarism-free and error-free work

- On-time delivery of the assignments

- 24/7 customer support

There are many more benefits you can get from experts. You even ask, can you take my online class they will help you with your classes as well. You can also get help with solutions related to Financial Management. And, even ask them for multiple subjects related to help. You just need to drop them a request asking, Could you please help me and take my online physics class for me? The expert will take the handover of your class and give you the desired assistance you need.

Frequently Asked Questions

| Q. What other types of cost-benefit accounting assignment assistance students get from experts? A. Apart from the assignments help students get help with Cost-benefits essays, Online cost-benefits dissertation papers, professional cost-benefit case study papers, Cost-benefits homework papers and many others. |

| Q. What are the types of cost accounting? A. There are three types of cost accounting; Standard Costing, Activity-Based Costing and Marginal Costing. |