Today let’s explore the world of financial wisdom that is curated by none other than Warren Buffet the greatest investor himself. Well, everybody knows that the Stock Market has innumerable opportunities for everyone. All one needs is the right guidance and the right approach to learn and understand it. Also, if you are an enthusiast willing to venture into the stock market who else other than Warren Buffet can be your guide? Here in this blog by Allassignmenthelp, there are a few must-read books that are recommended by Waren Buffet himself. Hence, have a glance at the list of his top books and pick out any of them you want to read first.

Remember that learning from the best is important for growth no matter whether you are a student or an investor. So, let’s get set and learn more about it, but, before moving further let’s know a bit about Warren Buffet!

Who is Warren Buffet?

Warren Buffet is known as the greatest businessman, savvy investor and a very generous philanthropist. He was born in 1930 in Omaha and he got interested in investing and the business world when he was very young. Also, he had a great interest in the stock market and is known as the legend of stock marketing. He is someone who has always been featured in the Forbes list of billionaires as he is one of the richest people in the world. Well, stock marketing and investing have that power as they can make a person earn a lot and this is the reason students are too much interested in learning finance and investing. This person has a net worth of $123.9 billion as of September 2023. This is another reason why students preach to him a lot, believe in his philosophy and are ready to walk in his path.

Everybody wants to know the secret behind their success, and almost every student is fascinated by Warren Buffett. Many students opt for finance to learn about investing and explore the stock market. However, finance is a challenging subject, and students often struggle with it, leading them to seek professionals for finance assignment help. They also seek to learn from experts about Warren Buffett’s success secrets, as he followed the Benjamin Graham school of value investing, which differed from conventional wisdom in many ways.

Different Approaches Used by Warren Buffet

There are many different approaches used by Warren Buffet as he had a different theory in his mind. People want to become like him and follow his path but walking his success path is hard and one should focus and learn why is does what he does.

- He highlighted the idea that investing in yourself is the key to walking towards success.

- One should not only focus on making smart financial decisions but also constantly expand their knowledge in the areas one is passionate about.

- In this way by learning and growing, you’re setting yourself on a path to accomplish your goals and thrive. For students, this emphasizes the significance of both financial learning and general knowledge in their lives.

- Warren Buffet was someone who was never concerned with the activities happening around the stock market, not even the supply-and-demand intricacies.

- He believed in the quote by Benjamin Graham— “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

- He sees the potential the company holds and then chooses the stock depending on that.

To gain a deeper insight into the stock market, students should start building a basic understanding of microeconomics. They should start learning and exploring concepts like supply, demand, and how markets work. This knowledge can help them make more informed investment decisions and enhance their knowledge. Also, when students need academic assistance, they can explore resources related to demand-supply analysis assignment help to enhance their learning further.

Some Must-Read Books For Students Recommended by Warren Buffet in 2023

There are a few books recommended by the investing legend from which students can gain valuable insights into the world of investing and finance. These are some favourite books of his that he had read and are somehow the secret of his success as he enhances his understanding by reading these books. By leaning on yourself in these books, you can pave the way to a successful future.

Here is the list of books:

Business Adventures

Business Adventures came into public notice when Bill Gates asked Warren Buffett for his best book and he sent a copy of John Brooks’ book in 1991. This one is a collection of New Yorker stories compiled by Brooks. For the co-founder of Microsoft, “Business Adventures” is a constant reminder that the principles behind a winning business remain constant. He wrote, For one thing, there is a crucial human factor in business endeavours, it does not matter whether you have a foolproof plan, a perfect marketing pitch or a perfect product, you will still require the right people to follow and implement the plans. Truly, the book has gained popularity as Warren Buffett’s recommendation in recent years.

Also Read-Map Your Financial state To Study In An Expensive Country Like The UK

The Intelligent Investor

Buffett was 19 when he came across a copy of “The Intelligent Investor”. It is a book by Benjamin Graham that highlights the basics of value investing. Graham is considered as one of the most notable value investors of his time and this book is one of the best in Warren Buffett’s recommendations on book reading. The words of the legendary Wall Streeter impacted him immensely after reading this book and ultimately shaped his investment career. Specifically, he considers it as one of the fortunate moments of his life as it let him develop an intellectual approach to investing.

Dream Big

Cristiane Correa presents the story of three Brazilian founders of 3G Capital. This massive investment firm joined hands with Warren Buffet in 2013 in the acquisition of H.J. Heinz. In an interview with The New York Times, Correa highlighted that there were three reasons behind 3G Capital’s success: their cost-cutting strategies, management style and meritocracy. Dream Big came into public notice as Warren Buffett’s recommendation in the Berkshire Hathaway shareholder meeting that was held in 2014. Besides, it is one of the astounding books recommended by him.

Almanack

Poor Charlie, the author of Almanack serves as a vice-chairman of Warren Buffett’s Berkshire Hathaway. Overall, this book is a collection of suggestions from the great investor Charlie Munger. In the 2004 letters to shareholders, Buffett praised Almanack’s edition by Peter D. Kaufman. Warren Buffett said, “Scholars have for too long debated whether Charlie is the reincarnation of Ben Franklin. This book should settle the question”. Besides, this book encapsulates information on Charlie Munger’s life. Accordingly, it also reflects his sought-after philosophical opinions on the conversations Munger had at the meetings of Berkshire Hathaway on investing. To summarize, Almanack offers an insightful look at the world of stock market investment.

Ground Rules

In 2015 Warren Buffett wrote “Mr Miller has done a superb job of researching and dissecting the operation of Buffett Partnership Ltd. and of explaining how Berkshire’s culture has evolved from its BPL origin,” Also, he voiced that the people who find fascination in investment practice and theory will enjoy Ground Rules. Extracting letters from the letters Buffett wrote to his partners between 1956 and 1970, Jeremy Miller, a genius financial advisor dissected the book as Buffett’s ‘ground rules’ for investment.

The Clash of Cultures

The Clash of the Cultures is a book that Buffett reads himself. This recommendation was brought up in his 2012 shareholder letter. In this book, the author John Bogle presents that speculations of the short-time period are crowding out long-term investing options. The Clash of Cultures has ten complete and action-worthy steps which investors from all backgrounds can adopt. Bogle is of the view that his strategies may not be the best ones ever devised. There are way too many worse strategies in the market.

On the whole, this one is undoubtedly an intriguing and insightful read offering various practical suggestions for investors. Beyond that, one can understand how to build a good investment strategy.

Also Read-Why Finance is Still A Lucrative Career Opportunity For Students In 2020

Security Analysis

Buffett has stated that he finds himself fortunate to have teachers like David Dodd and Benjamin Graham at Columbia University. He strongly recommends the books written by these two bright minds on investing. On his impact of “Security Analysis” he said that the book is a roadmap for the investing he has been following for 57 years. Furthermore, he said regarding the roadmap that the book laid, Buffett “commented, “There has been no reason to look for another.”

The major insight of “Security Analysis” is that if an analysis is well-planned, one can easily understand the value of an entity. It can be easily understood what the market realizes about the company. Warren Buffett considers Graham as one of the most influential figures in his life. Further, he even regards him as the second most impactful person after his father.

The Outsiders

Warren Buffett recommended The Outsiders in his shareholder letter from 2012. Indeed, it was one of his several recommendations that he considers reading worthy. He said, “The Outsider is an outstanding book about CEOs who excelled at capital allocation.” Again, this clearly shows that he had high praise for the book and recommended it. Subsequently, Berkshire Hathaway has a major part to play in the book. A chapter of The Outsiders is based on Tom Murphy, the firm’s director. Buffett regards the same as “overall the best business manager I have ever met.”

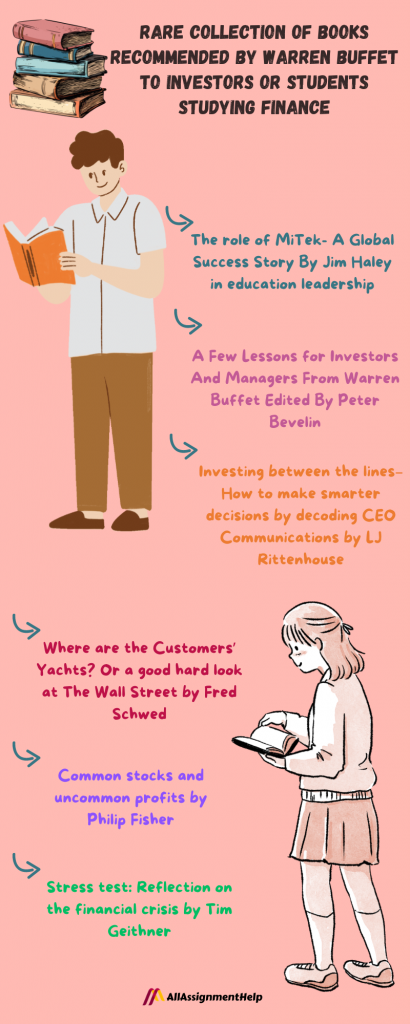

Rare Collection of Books Recommended by Warren Buffet to Investors or Students Studying Finance

These are some of the recommended books which are very useful for students who want to understand about investing and are finance students. But, these books are very rarely found and hard to get. These books are also beneficial for students who are studying corporate finance which is quite a popular subject among students. Well, after reading these books many students have quoted that this is the book that has changed my perception towards life.

MiTek- A Global Success Story By Jim Haley

This is another of Warren Buffet’s recommendations. Truly, this is one of the books that is not easy to buy. You cannot buy it on Amazon. This book talks about MiTek Industries Inc., which was a supplier of engineered products in the construction sector. This book consists of the story of how a company began as a small line firm in 1955 and almost became bankrupt. Then again it eventually became a dominant presence in the industry.

A Few Lessons for Investors And Managers From Warren Buffet Edited By Peter Bevelin

This is one of the short-read books suggested by Warren Buffet. This book consists of 81 pages that are edited by Peter Bevelin. This is an easy and must-read book for investors and managers. In this book, you will learn things from the wisdom of the Oracle of Omaha. In this book, you will read in the words of Warren Buffet how to think about crucial topics.

Investing between the lines– How to make smarter decisions by decoding CEO Communications by LJ Rittenhouse

Warren Buffett’s recommendation on reading this book in his 2012 annual shareholder letter. In this book, you will find that LG Rittenhouse uses more than a decade of research to tell about the system that measures the trustworthiness of an organisation as a prediction of its investment potential. This book will help you to solve the problem for investors who want to invest between the lines.

Also Read- Is Business related To Economics?

Where are the Customers’ Yachts? Or a good hard look at The Wall Street by Fred Schwed

This is one of the Warren Buffett recommendations in the shareholder letter of 2012. Warren Buffett says, “This is the funniest book ever written about investing. It delivers many truly important messages on the subject.” This is one of the best recommendations by Warren Buffett. It is an invigorating and engaging read from start to finish

Common stocks and uncommon profits by Philip Fisher

Philip Fisher is another historical name in the world of stock market investing. Additionally, in this book you will read about how to fixate yourself on financial statements when it comes to making your stock picks is not enough. There is also a need to evaluate the management of the company.

Stress test: Reflection on the financial crisis by Tim Geithner

This book is written by the former US Secretary of the Treasury. This recommendation is a must-read for any manager, especially during a financial crisis. Indeed, this book is an energizing read recommended by the man behind Berkshire Hathaway.

Last Thoughts

Warren Buffett’s suggested books for students provide an invaluable opportunity to develop financial literacy and enhance investment skills. By diving into these books you can pave the way to a successful future in the stock market, finance and business. Remember that it’s okay to seek online assignment help or professional guidance to maintain a healthy balance between academics and investing. With the right resources and support, you can get to explore your full potential as a student investor. Furthermore, for more interesting articles you can refer to our blogs section and read more blogs referring to different topics. For any assignment help, you can contact us anytime even if you are looking for corporate finance planning assignment help or any other corporate-related assignment assistance.

Additionally, here is a sneak peek of what holdings Warren Buffet invests in:

- Apple, Inc. (AAPL)

- Bank of America (BAC)

- American Express (AXP)

- Chevron (CVX)

- Coca-Cola (KO)

- Kraft Heinz (KHC)

- Occidental Petroleum (OXY)

Frequently Asked Questions

| Q. What is Warren Buffett most famous for? A. Warren Buffett is most famous for being one of the richest and most successful investors in the world, and for leading Berkshire Hathaway, a giant investment company. |

| Q. How does Warren Buffett make money? A. Warren Buffett makes money by buying shares of companies at low prices and selling them at higher prices, and through dividends. He focuses on companies that are undervalued but have strong potential for growth. |

| Q. What are Warren Buffett’s 5 rules of investing? A. Rule 1: Invest in what you know. Rule 2: Look for companies with a competitive advantage. Rule 3: Invest in companies with low debt. Rule 4: Know the difference between price and value. Rule 5: Be fearful when others are greedy, and greedy when others are fearful. |