Table of Contents

Budgeting tips for students: The experience of studying in an elite college is exciting, but to get the most out of it, you must manage your money well. College students’ budgets can become tight due to the numerous other costs they must cover, including housing, food, transportation, and other essentials, in addition to tuition.

Financial security requires knowing how to prioritise your expenditures and make a budget. Whether you’re searching for a budget plan or need budgeting tips for students, this blog post by allassignmenthelp, will help you make the most of your resources and save money without sacrificing enjoyment.

Why Do You Need Budgeting Tips For a College Student?

A well-designed college budget plan enables you to successfully manage your income and expenses, giving you financial control. Also, it helps us figure out how much of your monthly money should go towards necessities and how best to spend the remainder. You may create more intelligent spending and saving habits and improve your financial awareness with a well-organised student budget.

When you budget wisely, you’re not just saving money; you’re making room for important academic investments. For instance, if you manage your daily expenses smartly, you might have enough left over to spend on educational support services like online assignment help. This can be especially useful during exam seasons or when you’re juggling multiple deadlines. In this way, budgeting not only reduces stress but also ensures you have access to the tools and resources that support your academic success.

Read Also: Online Study for Competitive Examination

How To Make A Budget For College Students

What is the purpose of a budget plan? It helps you manage your finances by determining how much you must spend each month and what you do with the remainder. Your understanding of your finances and how to manage them will improve with a monthly plan. For that, you need good budgeting tips for students.

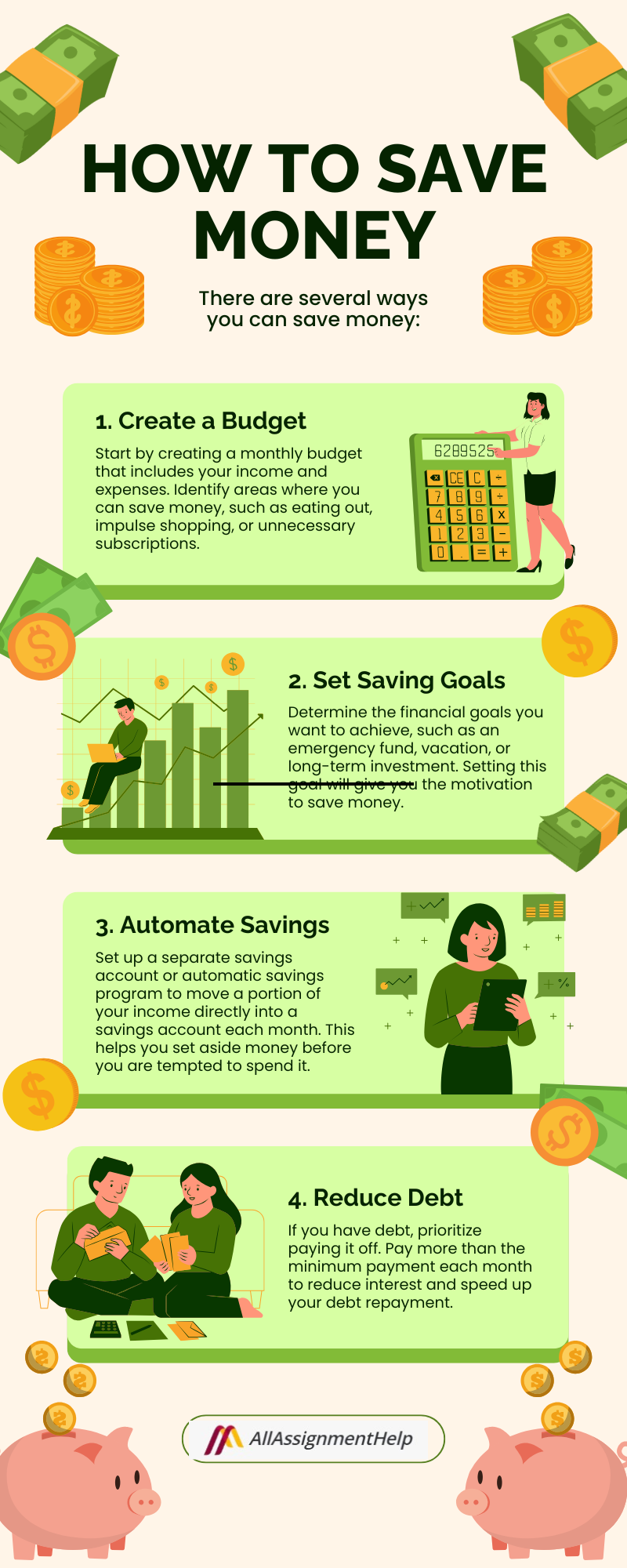

But how do you do that? You divide it up into four distinct steps:

Step 1: Write the monthly earnings in writing.

Just put the amount of money you have available each month on paper.

Step 2: Understand what you spend your money on

Before you can begin making cuts or choosing more economical options, it’s critical to understand what you spend your money on. This is the second stage in learning how to budget as a student. Creating a list of all your potential expenses is the simplest way to get started.

For example:

- Tuition costs, which are likely your biggest outlays;

- The second-largest price that students usually have to pay for is housing; the kind of housing you choose also affects how much you

- Sharing an apartment or living in a dorm tends to be less expensive than renting an apartment alone.

- You’ll probably need to pay for heating, electricity, water, and the internet;

- Consider your options for getting to university, including walking, bicycling, driving, and public transportation, as well as the prices of each.

- Do you like to dine out or are you able to cook? Naturally, the first choice is far less expensive;

- Based on your subject of study, you may need to purchase specific books and materials.

Step 3: Calculate the estimate

In this section, you deduct expenses from revenue until you are close to zero. To ensure that no money goes missing, it entails giving each dollar a purpose. But it doesn’t mean you’ll spend every penny of your monthly budget!

The 50/30/20 approach is one of the most often used strategies for budget organisation. It can be one of the best budgeting tips for students.

Step 4: Keep track of your expenses

You can begin tracking your finances now that you have a solid plan. Keep track of everything you spend over the month and consult your plan as needed. Instead of just purchasing a coffee, deduct that amount from your allocation for wants. By doing this, you will become aware of your spending patterns and determine whether you are on the verge of going over budget on entertainment or other discretionary expenses.

You may change your budget plan before the start of the next month to reflect any observations or modifications made during the previous month.

By following these four steps, you can create a monthly budget and spend accordingly. When you follow the right strategy and manage your money wisely, you can save a significant amount. You can then use these savings on your hobbies or to level up your skills by enrolling in online courses. These courses are specifically designed to enhance your abilities, which can benefit your profession and career. If you ever feel, you cannot complete your online classes and want to exit the course in between. We have a great solution for you. You may visit the online class help sites from where you can take expert help and ask them to take your online class for you. With their help, you can complete your classes on time and learn some additional skills too.

Read Also: Top Free Online Courses Every US Student Should Take

Budget Planning Tips for College Students

Once the foundation has been laid, it’s time to investigate some simple ways for students to save money. Your budget will improve when you incorporate these strategies, many of which are extremely easy things you can do.

Open an Early College Savings Account

Your parents may have selected one of the several college savings plans available to them before you were even in kindergarten. It’s time to discuss college funding with them if they did and you’re still unclear about the specifics. It’s time to start saving money for college if you haven’t already, particularly if you will be bearing the majority of the expenses.

Look for Ways to Earn Money While in College

Being proud of yourself for finishing college encourages frugal spending based on sound financial planning. Maybe you worked for a company in high school that offers jobs in your college town; if not, look into other employment choices while learning about the university and neighbourhood.

Keep in mind that there are many non-work-related methods to earn money, such as tutoring, dog walking, and blogging.

Pick a college sensibly

It’s like pondering the depth of a swimming pool after you’ve jumped in if you choose a school without knowing your financial limitations. Basically, don’t take on more than you can handle. Accordingly, you ought to be able to investigate your targets and:

Assess the financial situation of each school you are thinking about. Conduct a comprehensive cost comparison and make an informed decision.

When choosing a place to live, consider campus amenities carefully, including eating options and community and campus medical services.

Consider the expenses associated with your option, such as the cost of going home and the cost of transportation, both on and off campus.

Spend less on food

You might be tempted to eat out a lot if this is your first time away from home, but it will significantly affect your expenses. You ought to start cooking at home instead. It’s healthier in addition to being less expensive. A fast internet search will tell you everything you need to know, and there are many simple recipes available. If you live with one or more roommates, you can also share meals. Larger dinners are less expensive to prepare, and you can save even more money if you split the expenditures. Cooking together is also enjoyable.

Restrict your luxury spending

If you give it some thought, you might discover that many of the things we take for granted are necessities, and you can live without them. For a time, however. Here are a few instances:

Eliminate pointless subscriptions; for example, if you have a premium music streaming service, such as Spotify, the free version is perfectly adequate. Instead of purchasing books, check out the library’s collection. Although it might not taste as good as Starbucks coffee, making your own will save you money.

Reduce your borrowing

Don’t take out more loans than you can manage, and only use them for school-related costs, not frills, vacations, or pizza. Also, to reduce long-term interest, think about using any extra cash you have to pay back loans (such as interest-only loans) while you’re still enrolled in school.

Seek out student savings.

Student discounts are available at more places than you may think, so you might as well take advantage of them now. Additionally, it will teach you how to shop for discounts. When unforeseen costs occur that you didn’t account for in your budget, the additional savings can be helpful. For example, if you’re seeking online exam help, you might say, Please take my online exam for me, and could you offer a discount as well? Often, especially if it’s your first time visiting the site, you may receive some special offers or deals. Then, why not grab the opportunity?

Make use of public transport

If you are considering purchasing a car or currently own one, start by looking at the much more affordable and ecologically friendly options. Student discounts are always available on public transit, and in certain nations, they may even be free. It’s significantly less expensive to buy a bike than a car, and you’ll get a terrific workout every day on your way to university. Also, if your lodging is close enough to the school, you can walk there for free (consider this when choosing a place to live!).

So these are some amazing budgeting tips for college-going students. You may follow the above tips and soothe your academic journey.

Read Also: The Best Study Spots in Washington, D.C. for Students

Conclusion

Although it can be difficult, it is absolutely possible to manage your finances as a student if you use the appropriate techniques. You can save money and stay within your budget by keeping track of your earnings and outlays, taking advantage of discounts, cooking at home, consuming reasonably priced entertainment, and using economical modes of transportation. Working part-time might also yield significant experience and additional revenue. You may have a stress-free student life if you prepare ahead and make wise decisions.

Moving to a new nation and being away from home doesn’t have to be frightening. You will be financially secure when you are a student if you are organised and have a good budget.

FAQs

Q. Are there any tools or apps that can help with budgeting?

Yes, tools like Mint, YNAB (You Need A Budget), or college-specific finance apps can help you plan and manage your budget more efficiently.

Q. What should I do if unexpected academic expenses arise?

If you face sudden academic costs, such as needing urgent online assignment help, use emergency funds or saved discounts. Always keep a buffer amount in your budget for such situations.

Q. What is the best way to create a budget?

A common method of proportional budgeting is to divide your post-tax income into three parts: 20% for debt repayment and savings, 30% for wants, and 50% for necessities.